Related Articles

As long-term stewards of capital, we believe it is critical that businesses, investors, and capital allocators factor climate change into their long-term strategies as they would any other environmental, social, or governance issue.

About 150 miles south of our headquarters, in Norfolk, Virginia, sea levels are rising among the fastest on the East Coast. Large parts of this city, which is the home of the world’s largest naval base, will be regularly underwater by 2050 if levels continue to increase at this pace.1

Naval installations face the most obvious danger from climate change because their sea-facing posture puts sailors, ships, aircraft, ports, and other critical infrastructure at risk. But a warming planet will not only affect military readiness. It can influence food security, public health, migration patterns, and, potentially, geopolitical stability. Indeed, climate change has quickly moved from a distant risk to a present-day threat.

As long-term investors, we need to know how these risks will ultimately affect our businesses and our portfolios. Climate change can have a material impact on a company’s revenue and expenses, the value of its assets, and the availability and cost of capital. Businesses, investors, and capital allocators must factor these impacts into their long-term strategies.

Climate Change Takes Center Stage

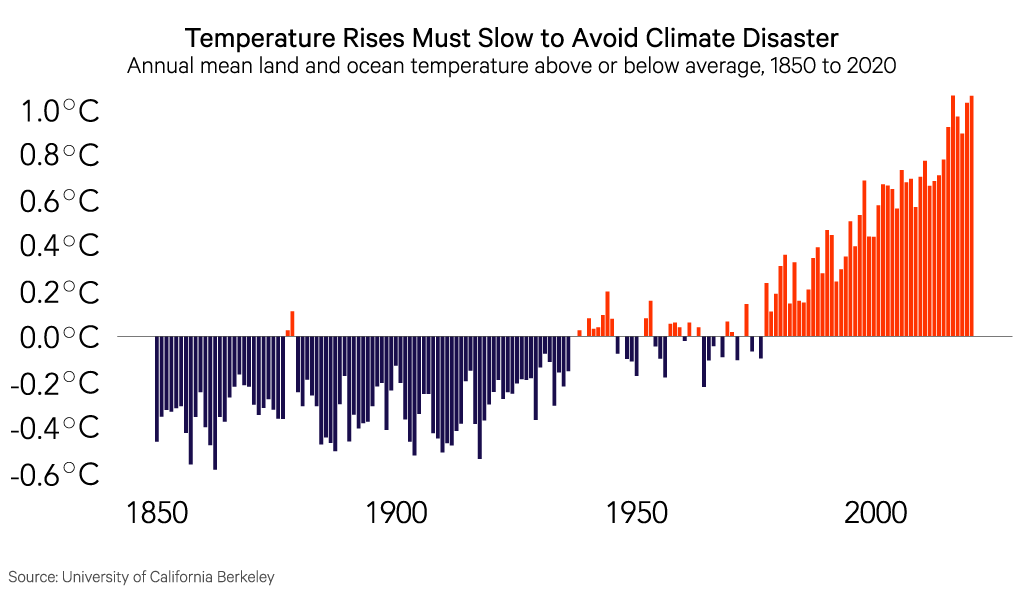

Scientists have long warned about climate change. The release of greenhouse gases from human activities has warmed the earth by about 1.1°C since the beginning of the 19th century. Without substantial action to reduce emissions on the part of governments, companies, and the general population, the planet is expected to warm by another 2.6°C to 3.1°C over the course of this century.2 The Intergovernmental Panel on Climate Change (IPCC), a U.N. body, has made clear that we must stay within 2°C—but ideally 1.5°C—to avoid catastrophic effects from climate change. It is estimated that target can only be achieved if carbon dioxide emissions reach net-zero by 2050.3

As the scientific evidence mounts, several trends have moved the issue of climate change to the top of the agenda for investors, companies, and policymakers.

First, and probably most obvious, the physical effects of climate change are compounding and becoming more pronounced. We have seen more frequent and severe floods, droughts, wildfires, hurricanes, tornadoes, and other devastating events that threaten people’s lives and livelihoods and that disrupt local economies. For instance, climate change is making heat waves longer, hotter, and deadlier. In the United States, extreme heat kills more people each year than any other kind of natural disaster, and according to the World Health Organization, researchers estimate that 37 percent of global heat-related deaths are directly related to climate change.4 Further delays in action, with temperatures rising to just under 2°C, are projected to cause annual heat-related deaths to rise 370 percent by mid-century.5

Second, new technologies have improved access to information and raised public awareness of this devastation and its causes. Globally, people have become more informed about climate change, and a larger part of the population has voiced their concerns to policymakers. Consumers, especially in wealthier economies, are increasingly demanding products that are environmentally friendly. Thanks to mobile technology, they now have more tools to make more informed consumption choices.

Finally, policy action is also picking up around the globe. New laws and regulations are being implemented with increasing speed, scale, and breadth, and we believe this trend will only continue. To date, 196 countries and the European Union (EU) have signed the Paris Agreement, a landmark international agreement to keep global warming to well below 2°C and preferably limit it to 1.5°C. More countries are putting their emissions reduction commitments into law. Several have set deadlines to phase out automobiles with internal combustion engines.

Action has spread to financial markets as well. The EU has been rolling out a substantial regulatory package focused on promoting sustainable practices in financial markets. The United Kingdom was one of the first countries to mandate that large companies and financial institutions align with recommendations of the Task Force on Climate-related Financial Disclosures (TCFD),6 and on March 6, 2024, the U.S. Securities and Exchange Commission adopted climate disclosure requirements for companies.7

Investors Prioritize Climate Change

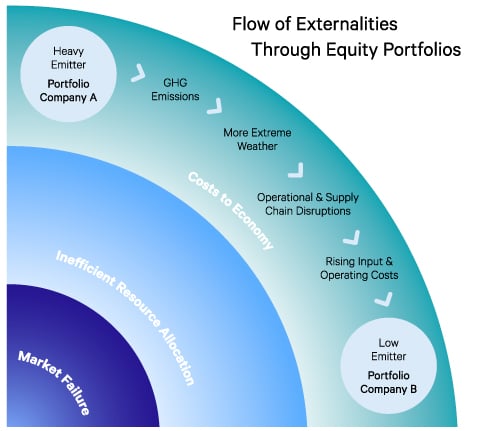

All this is leading investors to focus their attention on climate change, which in turn feeds public awareness and regulatory trends. In particular, “universal asset owners” that are exposed to most of the market have become more active on the topic of climate change and emissions reduction. Climate change is perhaps the most obvious and systemwide example of the harmful side effects—or externalities—of industrialization. It can cause myriad downstream effects. For instance, carbon dioxide emitted by coal plants contributes to global warming and changing weather patterns, which in turn can reduce crop yields. Less supply leads to higher food prices and ultimately reduces consumer spending power, which can lead to an overall economic slowdown. In fact, some studies project that climate change could slow the global economy by up to 18 percent by 2050.8

For universal owners, this has implications for their entire investment portfolios. Some, like pension funds, have multidecade or even infinite time horizons. It is in the interest of such institutions to drive emissions reduction across their range of holdings, regardless of whether a particular company is a heavy emitter or not, given the entire economy’s imperative of achieving net-zero.

Regardless of whether we ultimately meet the goal of net-zero by 2050, it is clear that climate change will fundamentally affect our world over the next decade and beyond. As long-term investors, we need to be aware of the risks and opportunities the overall economy and individual businesses face from a warming planet. These can be physical and take the form of changing weather patterns and rising sea levels. For example, insurers are increasingly incorporating the effects of extreme weather into premiums or limiting coverage altogether.9 Climate-related risks and opportunities can also be transitional, resulting from changes in regulations and advances in technology. Some companies, for example, have begun to incorporate a “shadow” carbon price into capital allocation decisions. Data from a 2021 CDP report indicates 20 percent of the 5,345 global companies responding to the CDP’s climate questionnaire said they used an internal carbon price, and 22 percent planned to do so within the next two years.10 Others are developing technologies to capture carbon from the air.

We believe it is critical that businesses, investors, and capital allocators factor climate change into their long-term strategies as they would any other environmental, social, and governance (ESG) issues. However, climate change differs from other ESG risks in some key ways. First, it is a nonlinear risk with no historical precedent. While we know that the average earth temperature is rising, geography-specific consequences are harder to assess. Some places will become hotter and drier, while others might become colder and wetter. So-called feedback loops and tipping points can produce sudden and unpredictable changes to the earth’s climate. Second, climate change suffers from a collective action problem as well as a timing mismatch or what former Bank of England governor Mark Carney has termed “the tragedy of the horizon.”11 By the time many of the effects are truly felt systematically throughout the world, it might be too late to reverse them. Third, the risks presented by climate change, unlike other ESG factors, will eventually affect almost every sector of the economy, although the exact risks and opportunities will differ by industry.

Integrating Climate Change Factors Into Our Investment Process

There is much debate about how best to fight and adapt to climate change. We acknowledge both the complexity and unpredictability of climate change as well as the challenges in mitigating it, and we do not purport to have all the answers. What we can do is focus on the things that matter and that we as investors can control. Our approach to climate change to date has been a pragmatic and materiality-based one, driven by our core investment philosophy.

That philosophy is embedded in our six investment criteria and emphasizes the importance of a company’s ability to sustain growth over a long time horizon (usually five-plus years) and leads us to businesses that are thoughtful stewards of financial and nonfinancial resources. This emphasis tends to lead us to high-growth companies that typically operate in less carbon-intensive industries or to companies undergoing structural shifts away from reliance on more carbon-intensive business lines. The residual effect of our criteria-driven approach are portfolios that often have carbon-intensity measures lower than the passive market benchmark.

Some businesses are very strategic in linking environmental sustainability to long-term value creation. For example, many of our internet businesses operate large-scale data centers that consume significant electrical power. In fact, electrical power is one of the largest line-item costs of operating data centers. This creates an economic incentive for those businesses to reduce energy consumption. Many have set aggressive reduction targets, are leveraging creative solutions to achieve those targets, and are taking steps to shift the balance of their energy consumption mix to renewable sources.

We also see significant investment opportunities in businesses that are contributing to the decarbonization or greening of our economy. By some estimates, the shift to a greener economy could result in a direct economic gain of $26 trillion by 2030 compared with a business-as-usual scenario.12 This has the potential to create jobs, propel forward new technologies, and create new markets. We seek to be invested in innovative businesses that not only have future-proofed their business models but that will be a part of this transition. While much focus is on renewable energy, we take a broader view of the potential solutions. For example, we have invested in companies that make software to make jet engines more efficient, specialty chemicals that improve energy efficiency in buildings, and technology that is used in the electrification of vehicles.

Cloud computing, digitalization, automation, and even artificial intelligence are some of the trends that we believe will help drive down energy and resource consumption over the long term and ultimately contribute to decarbonization. Many of our companies are active drivers of these trends.

Beyond identifying opportunities, we believe we must also look around the corner for climate-related risks. To the extent that climate change may affect the sustainability of a company’s value-creation potential over our investment horizon, we evaluate the potential impacts and factor them into our investment case. We believe that we must also encourage our companies to identify climate-related risks and opportunities relevant to them, measure and reduce their carbon footprint, and make adaptation plans when necessary.

To this end, we have analyzed and mapped our portfolios in terms of carbon emissions and intensity, climate value at risk, and carbon reduction targets. Within each of our portfolios, we have a clear view into the most carbon-intensive businesses and their trends over time. We know which businesses have established credible, science-based decarbonization targets. Using these reference points, we are attempting to engage with certain businesses with an aim to positively influence how they address the climate-related risks to their business models and the indirect costs they present to society. Through these engagements, we aim to understand management’s intentions for how it will approach decarbonization, how reduction targets are set and measured, or why the business has yet to establish credible targets and what management can commit to.

To continuously improve our understanding of how climate-related issues affect our portfolio businesses, we have also committed to training and education, to the implementation of specialized tools and data, and to supporting organizations such as the TCFD and the CDP to encourage better disclosure from companies.

At Sands Capital, we are privileged to hold a significant ownership position in many of our businesses. This “seat at the table” enables us to be a committed partner for change on a variety of levels. As long-term stewards of capital, we believe we have a duty to our clients to understand and seek to mitigate climate risks in our portfolios, identify positive climate opportunities, and engage with companies in an effort to influence the trajectory of our portfolios and, ultimately, the global economy, over time.

(Data updated November 2024)

2 https://www.unep.org/resources/emissions-gap-report-2024

3 Net-zero emissions are achieved when there is an overall balance between greenhouse gas emissions produced and greenhouse gas emissions taken out of the atmosphere.

5 As of November 14, 2023; https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(23)01859-7/abstract

6 https://www.nature.com/articles/s41599-019-0329-3

7 https://www.sec.gov/news/press-release/2024-31

8 https://www.swissre.com/media/press-release/nr-20210422-economics-of-climate-change-risks.html

9 https://newsroom.statefarm.com/state-farm-general-insurance-company-california-new-business-update/

10 https://www.reuters.com/sustainability/no-global-carbon-price-some-companies-set-their-own-2023-12-10/#:~:text=An%20analysis%20by,have%20done%20so The CDP was called the Carbon Disclosure Project until the end of 2012. It is a not-for-profit organization that aims to study the implications of climate change for the world’s principal publicly traded companies.

12 https://www.un.org/en/climatechange/science/key-findings

Disclosures:

The views expressed are the opinion of Sands Capital and are not intended as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell any securities. The views expressed were current as of the date indicated and are subject to change. This material may contain forward-looking statements, which are subject to uncertainty and contingencies outside of Sands Capital’s control. All investments are subject to market risk, including the possible loss of principal. Readers should not place undue reliance upon these forward-looking statements. There is no guarantee that Sands Capital will meet its stated goals. Past performance is not indicative of future results.

As of October 1, 2021, the firm was redefined to be the combination of Sands Capital Management, LLC and Sands Capital Alternatives, LLC (previously known as Sands Capital Ventures, LLC). The two investment advisers are combined to be one firm and are doing business as Sands Capital. Sands Capital operates as a distinct business organization, retains discretion over the assets between the two registered investment advisers, and has autonomy over the total investment decision making process.

Notice for non-US Investors