Contributors

Related Articles

About a year and half after generative artificial intelligence, or gen AI, first captured the public’s imagination with the launch of ChatGPT, we are witnessing a similar diffusion of innovation. This time it’s driving an explosive demand for computing power and systems, enabling new use cases that will allow businesses, schools, consumers, and society in general, put gen AI to work to tackle tasks both complex and mundane.

Key Points

- Emerging use cases are confirming our expectations of an exponential increase in compute demand and that the substantial investment in research and infrastructure is more than hype.

- Our expected 75-fold increase in compute capacity should improve artificial intelligence (AI) performance and cost and has the potential to enable an explosion in yet-to-be imagined use cases, benefiting companies that make, sell, and use generative AI.

- We believe many of our companies are well positioned to benefit from the evolution of this megatrend. Leveraging our time-tested framework, we will continue to assess the emerging applications that have the potential to produce long-term wealth creation opportunities for our clients.

When Steve Jobs unveiled the iPhone in 2007, most people could not conceive of how this smartphone, which replaced buttons with a touch interface, would, over the decades, become the control center for much of their lives.

Few envisioned how the device would spawn more than 2 million applications engineered in their most basic sense to solve a problem, answer a question, or automate a process. Gradually, however, through the use of a digital device, people could order food, book air travel, find dates, and navigate backroads and byways.

Today, about a year-and-a-half since gen AI first captured the public’s imagination with the launch of ChatGPT, we are witnessing a similar diffusion of innovation. This time it’s driving an explosive demand for computing power and systems, enabling new use cases that will allow businesses, schools, consumers, and society in general, to put gen AI to work to tackle tasks both complex and mundane.

Businesses are moving from building the capabilities to run gen AI to putting it to use to drive efficiency gains, lower costs, and provide more personalized services. Gen AI is also traveling a well-worn path of technological adoption, moving from the center to the periphery—or the edge. Before long, we expect we will see something comparable to the above-mentioned iPhone moment with a proliferation of AI apps that could spur a whole new class of businesses yet to be imagined.

Over the past year, many investors have questioned the runup in stock prices of select businesses along the semiconductors supply chain—in particular, NVIDIA, which has been the architectural leader. But based on the research we’ve conducted over the past several months, we have gained conviction that demand for computing power and storage will continue to grow. That’s because many businesses will seize the promise of AI in an effort to gain or increase their competitive advantage, lower costs through increased productivity and efficiencies, and ultimately expand margins.

As a result, we do not expect that businesses will have difficulty in justifying investments into building or buying AI.

The Promise of Gen AI

What business doesn’t want to lower its operating costs and reduce time spent on mundane tasks? And how much would a company or consumer pay to reduce time spent, for example, on paperwork? Often these tasks can divert people from their value-adding work. For example, we’ve estimated that police officers can spend 40 percent of their time writing reports rather than policing.1 To help address this, portfolio business Axon is building AI capabilities that pull data from its body cameras to make report writing more efficient. We believe this is an example of how AI could be used, not to replace jobs, but to enable people to concentrate on more meaningful work.

Labor is the largest component of the economy. So it’s reasonable that for hundreds of years, people have looked to innovation to create measurable improvements in labor costs, productivity, and ultimately economic growth (Exhibit 1.) Therefore, if AI can enable businesses to find efficiencies, such as those police departments can realize through using a product, such as Axon’s, productivity gains could be staggering. While such substantial savings may not be common today, as AI infrastructure strengthens and becomes more efficient, we expect they will become more ubiquitous.

Exhibit 1

BOOSTING PRODUCTIVITY THROUGH INNOVATION

Contributions to Labor Productivity Growth (Percentage Points per Year)

Navigating the Paradigm Shift

In the context of paradigm shifts, 18 months—the time since gen AI took hold—is a relatively short period. In a related article Assessing the New AI Paradigm, we outlined our framework for investing through transformative periods of technological innovation. Over the past decades, we have invested through several paradigm shifts, including the move from mainframes to personal computers (PCs), the widespread adoption of mobile devices, and the migration to cloud computing. The framework has guided us through the challenges and opportunities created by such periods of disruption.

The framework has also helped us effectively navigate hype cycles that often accompany significant change. When a shift begins, we have found that, from an investment perspective, the first phase of value creation tends to happen among the infrastructure providers (Exhibit 2).

Exhibit 2

APPLYING THE FRAMEWORK TO AI

Powering the Revolution

This infrastructure phase is so critically important because to be effective, gen AI applications have to rapidly process vast amounts of data. Gen AI relies on deep learning neural networks, known as transformer models, to identify patterns in data to generate original content. The cost to train the leading-edge large language models (LLMs) is increasing by multiples each year. Compute requirements for this training are increasing even faster.

Over the next five years, we expect technology improvements, combined with substantial capital expenditures, to dramatically increase global compute capacity to make more advanced use cases possible. We expect this substantial build-out to provide certain benefits to our portfolio businesses that are critical players in the infrastructure phase, including NVIDIA, Taiwan Semiconductor, ASML Holding, Cadence Design Systems, Lam Research, Entegris, Lasertec, and cloud computing businesses, such as Amazon Web Services, Microsoft Azure, and Alphabet’s Google Cloud.

Of course, there may be fluctuations and cycles along the path to growth, and we will continue to carefully monitor supply and demand conditions to confirm our investment thesis. We have attempted to map how this compute capacity could expand in the coming years. We study the latest thinking, speak to experts, and meet with practitioners. We’ve estimated that the world’s compute capacity is set to expand 75-fold by 2030. The creation of ChatGPT was enabled by a massive increase in compute capacity over the past decade.2 However, the gains we expect by 2030 make the current compute capacity look like a rounding error. To illustrate its enormity in Exhibit 3, we utilize two different scales to depict the magnitude of growth over time.

Exhibit 3

INSTALLED BASE OF COMPUTE CAPACITY WILL CONTINUE TO EXPLODE, ENABLING BETTER MODELS

Humans tend to struggle to imagine this type of exponential change. But through our research, we are intent on envisioning what could be possible should compute capacity grow 75-fold.

NVIDIA’s CEO Jensen Huang provided a mental framework to help envision gen AI’s progression to attendees at the company’s annual GPU Technology Conference in mid-March. We have tokenized the human language, he said, explaining that we have broken language down into smaller units that algorithms can work with. Once that happened, we were able to add compute power to it, and we got to ChatGPT. Going forward every problem will get tokenized, and it is only a question of time and available computing power until we have gen AI in medicine, industrials, robotics, and other industries.3

We expect these myriad use cases across industries will arise as businesses continue to invest in the infrastructure needed to support the exponential growth in compute capacity. That is already unleashing the usage that would allow gen AI to change the world as we know it.

All the Apps We Cannot See

Gen AI is improving quickly, i.e., it is getting smarter. This is driven by the big increases in compute capacity discussed earlier. While we have seen concrete use cases emerge in digital advertising, we are still awaiting confirmation of how AI will support earnings, and of how applications will create a new generation of businesses. Perhaps we will see the emergence of personal assistants that will give everyone the support equivalent of an executive assistant.

Or we might see gen AI bring down the costs of customer service or create virtual lawyers that can handle simple legal questions. More broadly, a shift in the way people interact with computers, moving from a graphical to more human interface, could mirror the phase of the democratization of technology that happened when the graphical user interface replaced command lines.

At this point we don’t know. However, we wouldn’t be surprised if the situation paralleled the advent of mobile phones when compute advances led to the app explosion depicted in Exhibit 4, creating entirely new businesses and business models. Efficiency gains, such as those we expect Axon to bring to law enforcement, might then extend to every niche of society. Just as with mobile, we expect a handful of use cases to create the bulk of the value, so we believe our philosophy of concentrating our investments in our highest-conviction ideas positions us well for the future.

Exhibit 4

AI USE CASE EXPLOSION

AI apps could see exponential growth like Apple's App Store in it's first decade

Movement to the Edge

To date, most AI has been used in the data center with access via the internet. In the history of computing, we often see the centralized resource, such as a server or the cloud, working in tandem with the edge—the client or phone. We expect this to happen in the AI era as end-user devices become more capable of running gen AI algorithms. While they won’t be able to match the cloud in sheer power, they offer substantial benefits in cost, speed, and privacy. As the ultimate gatekeeper to its 2 billion users, we expect Apple to be a beneficiary and recently invested in the company in some of our strategies to take advantage of this potential opportunity.

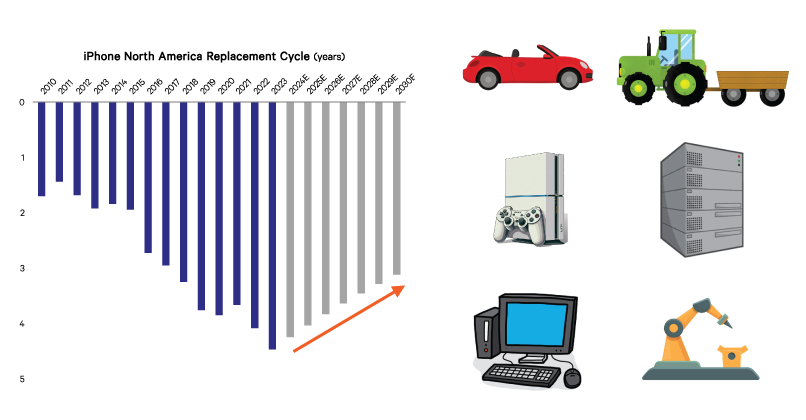

Apple’s hardware growth has been modest in recent years as smartphone sales have leveled off as the category matures. However, we expect growth to reaccelerate as Apple brings AI features to the iPhone and drives an upgrade cycle with the potential to add service revenue over time. Less than 10 percent of the Apple user base will have access to Apple Intelligence when it is released, and the current phone replacement cycle is its longest in history. Based on our research, we expect that edge compute requirements will keep rising, which favors a shorter replacement cycle.

Companies that experience more frequent replacement cycles, such as Apple and perhaps automakers and personal computer providers, could benefit from structurally higher earnings. While it will take time for Apple to realize service revenues, the company is positioned to capture consumer LLM revenues through subscriptions or other fees. Our models show earnings-per-share are expected to accelerate to the mid-teens over five years. We are looking at this trend across our portfolios to determine what other companies may be positioned to benefit from this movement to the edge and the accompanying replacement cycle.

Exhibit 5

MOVEMENT TO THE EDGE COULD SPARK A SIGNIFICANT HARDWARE UPGRADE CYCLE

The Importance of Leadership

As we move into the second and third phases of our framework, we are actively exploring ways in which businesses can derive value from gen AI, amplifying competitive advantages, developing new use cases, or benefiting from an inevitable replacement cycle driven by ever-increasing demands for power.

While we await the appearance of emerging disruptors, at present we see AI as a sustaining innovation for many incumbents. Innovation in AI requires considerable investment in infrastructure. It requires the continuous collection of data that can be harnessed to train the large language models, and it requires the scarce engineering talent required to build systems. This reinforces the importance of our leadership criteria. We believe many of the market-leading businesses that we own have substantial advantages in the AI future because they can more easily bring these resources to bear than smaller competitors whose financial constraints hinder their ability to invest in the needed infrastructure, collect the necessary volumes of data, and recruit qualified specialists.

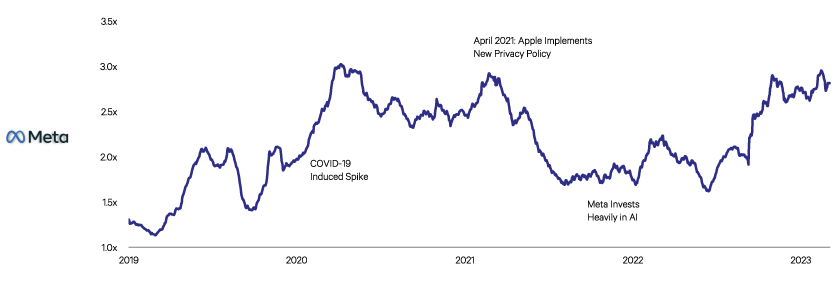

This is most apparent in digital advertising where Meta used its AI to offset the privacy changes that hurt its business in 2021. The exhibit above shows how AI allowed return on advertising spending to recover.

Exhibit 6

SCALE PLAYERS HAVE INVESTED TO EXTEND ADVANTAGES

Meta Return on Ad Spending

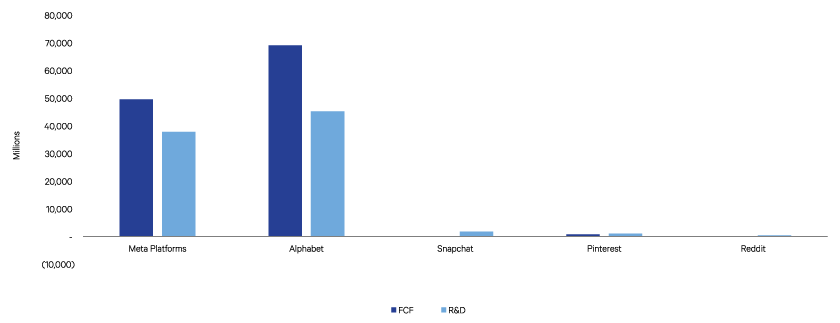

More broadly Meta Platforms and Alphabet’s Google deployed AI to improve the efficacy of their ads with Advantage+ and Performance Max, respectively. We can see the benefits of leadership in the business results of those two companies against smaller advertising companies. For example, in the first quarter, in addition to increasing its advertising revenue faster off nearly a 30 times larger revenue base than that of its smaller peers, it was able to spend 20 times more on research and development as well.

Exhibit 7 shows the considerable advantages Meta and Alphabet hold over smaller rivals. With such advantages, we are not surprised to see their revenues outpacing smaller competitors that struggle to develop products, much less drive business results.

Exhibit 7

SCALE BEGETS A TECHNOLOGICAL ADVANTAGE

Aiming for Exponential

Gen AI has the potential to be one of the most transformational technologies in history. In less than a year, it has already benefited select infrastructure providers and helped businesses across industries increase efficiencies and lower costs. Having invested through past paradigm shifts, we have experienced the exponential growth opportunities such transformations can create for active investors who are able to differentiate between tangible value creation and hype.

Opportunity cost remains the biggest risk today, in our view. Fully aware that such transformations can end in speculative bubbles, we are closely tracking the reality and the hype around the rollout of AI. We believe the leaders benefiting most from AI proliferation remain fairly valued relative to both their near- and longer-term earning potential. And we are making deliberate investment decisions in a manner that we believe are in line with the long-term interests of our clients.

That said, in this rapidly changing world, our views can change, so we will continue to closely watch how the technology improves, how it’s adopted and proliferates throughout the economy, and how our businesses fare.

As an investor in innovative growth businesses that are shaping the future, we are humbly aware that our ability to create value for our clients is not in anticipating the day-to-day and quarter-to-quarter price moves but in predicting the direction and magnitude of the possibilities. Throughout our 30-year-plus history, that is what has mattered and what will always matter to us as long-term business owners.

1https://www.axon.com/products/draft-one

2 As measured in floating operating per second (FLOPS)

3 https://www.nvidia.com/gtc/keynote/

Disclosures:

The views expressed are the opinion of Sands Capital and are not intended as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell any securities. The views expressed were current as of the date indicated and are subject to change. This material may contain forward-looking statements, which are subject to uncertainty and contingencies outside of Sands Capital’s control. All investments are subject to market risk, including the possible loss of principal. Readers should not place undue reliance upon these forward-looking statements. There is no guarantee that Sands Capital will meet its stated goals. Past performance is not indicative of future results. A company’s fundamentals or earnings growth is no guarantee that its share price will increase. Forward earnings projections are not predictors of stock price or investment performance, and do not represent past performance. There is no guarantee that the forward earnings projections will accurately predict the actual earnings experience of any of the companies involved, and no guarantee that owning securities of companies with relatively high price to earnings ratios will cause a portfolio to outperform its benchmark or index. Company logos and website images are used for illustrative purposes only and were obtained directly from the company websites. Company logos and website images are trademarks or registered trademarks of their respective owners and use of a logo does not imply any connection between Sands Capital and the company. GIPS Reports found here.

Unless otherwise noted, the companies identified represent a subset of current holdings in Sands Capital portfolios and were selected on an objective basis to illustrate examples of the range of companies involved in paradigm shifts that we have seen transform technologies, especially over the past 30 years. They were selected to reflect holdings enabling or potentially benefitting from the adoption of generative artificial intelligence across multiple geographies. This article is part of a larger series on secular trends and features businesses and related companies that were selected to illustrate current underlying macroeconomic and secular trends.

As of June 30, 2024, Alphabet, Amazon, Apple, ASML Holding, Axon, Cadence, DoorDash, Entegris, Lam Research, Lasertec, Meta Platforms, Microsoft, NVIDIA, ServiceNow, Shopify, Taiwan Semiconductor, and Uber Technologies were holdings in Sands Capital strategies.

Any holdings outside of the portfolio that were mentioned are for illustrative purposes only.

The specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. There is no assurance that any securities discussed will remain in the portfolio or that securities sold have not been repurchased. You should not assume that any investment is or will be profitable. A full list of public portfolio holdings, including their purchase dates, is available here.

The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium-term (2 year) growth and higher sales-per-share historical growth (5 years).

The MSCI ACWI captures large and mid-cap representation across 23 developed markets (DM) and 24 emerging markets (EM) countries. With 2,939 constituents, the index covers approximately 85 percent of the global investable equity opportunity set. DM countries include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK, and the United States. EM countries include: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The MSCI Emerging Markets Index captures large and mid-cap representation across 24 emerging markets (EM) countries. With 1,379 constituents, the index covers approximately 85 percent of the free float-adjusted market capitalization in each country. EM countries include: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. The MSCI Emerging Markets Index was launched on Jan 01, 2001. Data prior to the launch date is back-tested test (i.e. calculations of how the index might have performed over that time period had the index existed). There are frequently material differences between back-tested performance and actual results. Past performance—whether actual or back-tested—is no indication or guarantee of future performance.

Information contained herein may be based on, or derived from, information provided by third parties. The accuracy of such information has not been independently verified and cannot be guaranteed. The information in this document speaks as of the date of this document or such earlier date as set out herein or as the context may require and may be subject to updating, completion, revision, and amendment. There will be no obligation to update any of the information or correct any inaccuracies contained herein.

Notice for non-US Investors.