Contributors

Related Articles

Some of the best-performing emerging markets businesses are often led by founders and families. We believe their passion and grit lead them to launch the innovative businesses that often challenge the status quo, create new opportunities, and establish enduring legacies.

Key Points

- In emerging markets, we have found that select founder- and family-led businesses possess a vision and long-term focus on wealth creation that closely aligns with our own.

- These founders and families often show a strong sense of personal ownership and prioritize long-term success over short-term market performance.

- For us, the key to investing in businesses with concentrated control structures is to ensure that our interests as a minority shareholder are genuinely aligned with those of the owners.

In 1987, 17-year-old Ding Shizhong packed up 600 pairs of shoes made by his father in their Fujian, China home and hopped a train to Beijing.

Their plan: Sell the shoes to consumers seeking trendy fashion and send some money back home to help their struggling family.

It was about 35 years later that we first met Ding as a long-term shareholder in his company Anta Sports Products. By then, he had peppered the needs of his family with some grit, passion, and learned know-how to build what has become the third-largest sportswear company in the world by revenue after Nike and Adidas.

Our six investment criteria frequently guide us to businesses led by mavericks like Ding, who possess the vision, courage, and stamina to launch and navigate innovative ventures that challenge the status quo, create new opportunities, and establish legacies that endure across generations.

In fact, 67 percent of our holdings by market cap across strategies are led by founders and families. Founders make up 61 percent, while a further 6 percent are held by families, who oftentimes have taken over from founders. In our emerging market (EM) strategies, the combined weight of founder and family-led firms is even higher at 71 percent, with 53 percent and 18 percent allocated to founder-led and family-led businesses, respectively.1

Exhibit 1

Concentrated Control Structures in the World and in Our Portfolio

Some investors might shy away from these businesses whose ownership structures are concentrated. However, we look beyond traditional metrics created by ratings agencies that often lack the context that we gain from years of on-the-ground research and in-person meetings with management teams across geographies.

We have found that the enterprise, perseverance, and ownership mindset of select founders and families can naturally align with our approach to long-term investing and, when combined with an appropriate level of prudence and restraint, often assuage any concerns we have about concentrated ownership structures. In fact, we have found that some of those founder and family-led businesses—especially those in emerging markets—have outperformed the overall investment universe and, in turn, created wealth opportunities for clients.2

Exhibit 2

five-year Relative Performance of em Founder- and Family-Led Businesses

While this outperformance, especially of the founder-led businesses, is notable over the five-year time horizon that we analyzed, the dispersion is large. We typically find that only a handful of these businesses significantly outperform, skewing the results for the whole category, while many perform poorly due to issues, such as nepotism, related-party transactions, or poor governance. In Exhibit 2, if we look more closely at the column showing 4.8 percent outperformance among the founder-led companies, we find that the top fifth percentile of founder-led businesses outperformed by 33.8 percent, while the bottom fifth percentile underperformed by 57.7 percent.3

At Sands Capital, we are in the business of finding the outliers—the exceptional wealth creators. So we don’t rely simply on averaged evaluations from ratings agencies. We dig in. We want to understand motivations, approaches to governance, and communications with investors.

The Paradox of Control

In the realm of publicly traded companies, investors frequently associate good governance with a straightforward ideal: widely held stock ownership, in which stakeholders equally share control in direct proportion to their economic stakes according to the principle of one share-one vote.

While it may be “ideal,” widely held is not universal. Principal shareholders, dual-share classes, founder-led firms, family-run conglomerates, state-owned enterprises (SOEs), and pyramid structures are some of the alternative ownership and control structures that can raise eyebrows and earn a ratings-agency flag. Certain of these present persistent challenges. For example, we have only rarely gotten comfortable with the merging of shareholder and political interests at most SOEs. Other structures are more of a mixed bag.

Concentrated control structures that typify founder- and family-led companies have both advantages and disadvantages. The same structures that enable a business to prioritize long-term success over short-term market performance can also lead to empire-building, decreased transparency, inefficiencies, and an increased risk of related-party transactions. In developed markets (DMs), strong regulatory frameworks and a large institutional investor base can help guard against abuses. In emerging markets, the institutional investor base may be smaller, and regulations may be less developed or strictly enforced. In our view, this places even greater responsibility on an active manager to avoid situations where controlling parties might exploit their control and to ensure alignment with minority interests.

At Sands Capital, we research governance issues as part of our overall research process. Assessments must be conducted within the context of each market, considering cultural nuances, business maturity, and the structure—and individuals—involved. In markets like the United States, a board with a small minority of independent seats tends to draw censure. In countries, such as China and India, it’s more typical. In such cases, the gravitas of the independent members, the company’s fiscal track record, and the presence of an independent audit or compensation committee might serve as more helpful clues.

Our research involves significant digging, including comprehensive on-the-ground interviews with competitors, customers, supply chain partners, and the controlling parties themselves. While we don’t draw lines in the sand, when we are confronted with concentration, we seek assurance that our interests will be represented. Chief among them is some level of transparency and willingness to engage. Ultimately, we are searching for an owner who innovates, capitalizes on new market opportunities, invests in research and development, and possesses a visionary perspective. We often share our views with our portfolio companies when we see opportunities for improvement.

Often, however, the study of ownership structures and their evaluation is an imprecise science. Categories such as principal shareholder, founder-led, and family-led overlap and blur together. MSCI classifies 7 percent of the companies in the EM index as both founder- and family-led.4 Founder, family, or state interests may use subcategories, such as super-voting shares, cross-shareholdings, and pyramid structures to concentrate control further.

This can make the process of building conviction as a minority owner very specific to each company.

Take Titan, for instance.

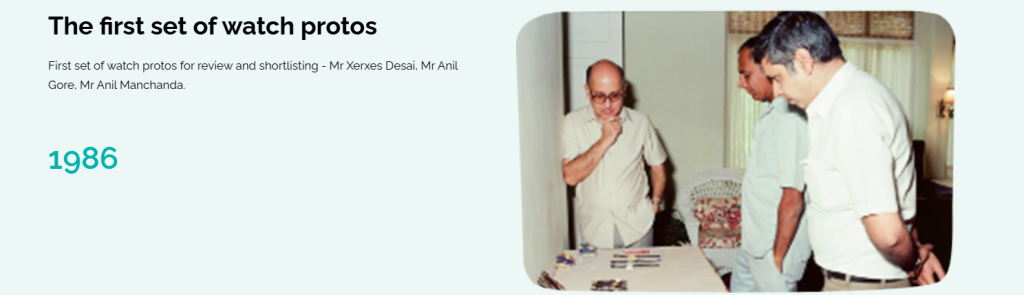

Around 2010, our analysts identified promising trends at the Indian company that today is fast gaining market share in India’s sizeable and highly fragmented retail gold and jewelry market. The company had formed about 20 years earlier as a joint venture between Tata Group—India’s largest by both market cap and revenue, and one of its oldest family-led conglomerates—and Tamil Nadu Industrial Corporation, a regional development authority.

At that time, the two partners agreed to put a professional management structure in place—at the time something rare in India, where family-owned businesses had dominated since the colonial era. They backed a Tata Group senior executive, Xerxes Desai, and his vision to build India’s first native luxury watch brand. They gave him wide latitude to pursue his vision, and he orchestrated a seamless transition to his protégé, another independent professional manager, who led the jewelry expansion. From our perspective, Titan was a pioneer that was able to capitalize on the trusted image of Tata while operating as an entrepreneurial, independent business. MSCI deems it a family-owned business and an SOE, but while that may be true at the surface level, we see a well-run, professionally managed company with a clear vision for disruption in an industry historically dominated by small mom-and-pop jewelry shops.

Perhaps most striking was the level of transparency exhibited by the Titan team. Indian jewelers were long notorious for shortchanging their customers, many of whom bring gold from home to have made into a new design or help offset their purchase price.5 Titan pioneered a “karatmeter” that instantly verifies the purity of a customer’s gold in real time. We observed a direct link between the company’s transparency with its customers and its governance. We have become accustomed to varying levels of disclosure from our EM companies. Disclosure laws regarding issues such as related-party transactions and executive compensation tend to be more limited than in developed markets, and companies often disclose only what is required. However, we have never experienced this with Titan. Even though we have periodically engaged the company on issues such as board independence and labor conditions in global precious metal supply chains, we have always felt comfortable with the transparency presented by the company.

Founding Principles

The advantages that can accrue to founder-led firms has been well documented.6 Anta’s Ding is a great example of a founder persona driving a business. These leaders generally possess a strong sense of personal responsibility for their business’s success and an urgency to get things done. Their willingness to make tough decisions with transformative potential can be hard for professional managers to match, especially considering the latter’s incentives are often tied to short-term earnings.

However, there is also the possibility that a founder can achieve an outsized level of influence over a wide range of stakeholders. In certain industries, such as software, the number of founders with the skills necessary to scale the tool or product they created is actually quite limited. Even in the most established and prominent founder-led companies, a cult of personality can develop. The founder may begin to believe in their own hype, allowing their ego to obscure the company’s mission and value-added focus. Companies in later stages of development might benefit more from flawless execution rather than an overwhelming vision. At some point, having a plan for, and the capability to make that transition may become crucial, even if the founder continues to hold concentrated control.

Some other characteristics that we have seen in emerging markets can create other concerns. As at many other EM founder-led firms, Ding maintains a tight inner circle, with about half a dozen senior executives making most major decisions. We believe this structure has enabled the company to be exceptionally agile in adapting to customers’ ever-changing tastes and preferences, but without proper planning it could have also elevated the “key person” risk.

from founder-led to global web

Throughout emerging markets, the founder-led model frequently bleeds into the family-led model. Anta is no exception. Along with Ding and his brother (the deputy chair), the board includes their brother-in-law and, until recently, a cousin.

We carefully evaluated these potential challenges before purchasing Anta, as at any business, and continue to monitor them throughout our ownership to seek to ensure that our companies are well managed.

We have consistently been impressed by our interactions with Ding’s family members. Ding has also been developing a strong talent team from outside the family, which has substantially reduced the key person risk. In 2010, one of them, a former head of Adidas in China, who joined Anta in 2008, became group president and executive director. Another, who worked his way up through the Anta sales ranks, is now co-CEO. Although the board is not predominantly independent, the chairman and CEO roles have been split (Ding gave up his latter duties), and the outsiders include a senior executive from Chanel Asia Pacific and the former China head of KPMG.7

Anta’s moves to expand have also impressed us.

The company has brought its manufacturing capacity and logistical support from operating 10,000 of its own stores to international brands. Through its ventures, the company has also brought those partner brands to China’s estimated 700 million middle- and upper-middle-class consumers.8

A critical test of Ding’s (and our) analysis of this approach arrived in 2018 when the company took on the most debt it ever had to acquire Amer Sports, the Finland-based owner of Arc’teryx, Salomon, Wilson, Atomic, and other high-end outdoor brands. Sell-side analysts were tough in their assessment, leading to a decline in the stock price. We gave management the benefit of the doubt and treated the deal as an option value. In early 2024, Amer Sports became a separately listed company, 43 percent owned by Anta, with a market capitalization that, as of early 2025, has swelled to $18 billion (more than half of Anta’s own).9 Forty-three percent of its profits are to be distributed to Anta.

Family-Led: A Prescription for Continuity

The distinction between founder-led and family-led companies is often just a matter of timing. Ding is still only 54, yet even now, MSCI classifies Anta as both founder-led and family-led and may drop the “founder-led” designation if Ding stops playing an active role and his heirs continue to exercise control. However, some qualitative differences emerge from such a transition that figure into our evaluation process of family-led structures. While the focus on legacy and long-term thinking may strengthen, the risks of inertia and related-party dealings can also increase. In 2024, McKinsey published a case report analyzing family-led businesses in India. It revealed a stark divergence between top-performing (in terms of revenue growth) family-led firms and the rest. One of the main differentiators? Seamless transition plans and full incorporation and integration of professional management.10

We established a position in Raia Drogasil, Brazil’s largest pharmacy retailer by revenue and number of stores, in 2011, shortly after the merger that united two of Brazil’s oldest and most prominent family-owned pharmacy chains: Droga Raia and Drogasil. Both families remained actively involved in the business, with strong track records of business execution and minority shareholder alignment. Their most influential member was Antonio Carlos Pipponzi. Known as “ACP,” he belonged to the second generation at Raia, having stocked the shelves when his father had only a few locations in São Paulo. His dedication to the company was such that it was said he rarely missed the opening of a new location—which by the early 2010s totaled over 300 ribbon cuttings a year.

Our attraction to the company centered on some key secular tailwinds—including increased drug spending by Brazil’s aging population and industry consolidation—along with the company’s strong financial position, free cash flow generation, and a well-defined growth strategy.

The company has put its stores within five kilometers of 60 percent of Brazil’s population and invested heavily in digitalization and loyalty programs. We envisioned the business significantly increasing market share and same-store sales. A major question was whether two controlling families could accommodate a deeper level of professional management, transparency, and oversight to support these initiatives and whether they could do so without disrupting a vital culture of personal ownership.

The more we spent observing and engaging with the company, the more confidence we had that the shift was working. Rating agencies sometimes flagged the operation for the types of governance issues associated with family-led businesses, such as insufficient disclosures and fewer outside checks and balances. We found this to be more about style than substance. The company had long been committed to external professional management and its well-regarded training programs. Post-merger, a new CEO, industry veteran Marcilio Pousada, formalized and deepened those commitments. The percentage of independent board seats eventually rose from one-third to two-thirds. Disclosure about executive compensation, a recurring MSCI concern, was addressed with the release of more detail on incentive structure and the overall figures. We have shared our view with management that information on individual pay is important for us to see.

In 2024, Pousada stepped down in favor of another veteran professional manager. To ensure continuity, Pousada took on the role of board chair, a move which required ACP to give up that position and move to another seat on the board.

This marks the first time in the companies’ 120-year history that no member of the founding families holds a top leadership position. ACP and the others demonstrate every indication of continuing to make their voices heard. Their attitude reflects another important nuance of the structure: The families cannot sell their shares for another six years. A phased lockup agreement executed as part of the merger and extended for another 10 years in 202111 freezes the families’ remaining combined ownership stake (23 percent12) in place until 2031.13 This agreement has helped support the stock through Brazil’s various macroeconomic upheavals over the past several years. It has also served as an additional security blanket for long-term investors like us, ensuring that the families have every incentive to remain fully engaged, even as they allow for greater transparency, accountability, and oversight.

Seeking Growth, Setting Limits

Still, no business is perfect, and great businesses are built over decades, not quarters. As long-term owners, we recognize that maintaining engagement over time can lead to positive outcomes. Our long-term perspective and global presence give us the credibility to share success strategies that we have observed at other businesses. Most management teams value our input. When we are not in support of how the issues are addressed, we have voted in favor of proxy-access and strengthened governance standards. It seldom reaches a point where we believe we have no choice but to walk away.

Yet, there are times when it does.

We were initially drawn to CP All, the exclusive franchisee of 7-Eleven in Thailand, because we see select convenience retail stores as an appealing business for long-term growth investors. We believe that this format is resilient to ecommerce, its leaders benefit from scale advantages, and the segment enjoys support from ongoing trends such as urbanization and ageing populations—both of which apply to Thailand. From the outset, we had concerns about the control exerted by the parent company, CP Group, overseen by the Chearavanont family.

For several years, we voted in favor of management’s board nominees due to their repeated commitments to enhance board independence. However, by 2021, we became increasingly concerned when the board seemed to pressure CP All’s management to use CP All’s balance sheet to acquire two large low-margin businesses unrelated to convenience retail, with no clear explanations of how this would enhance CP All’s business or maintain its focus. Before the 2022 general meeting, we met with the investor relations team to share our views on these concerns and ultimately voted against management’s nominees. No significant changes occurred. We concluded that CP All no longer met our fourth criterion that a company have a clearly articulated mission and remain laser-focused on bringing value-added solutions to its customers and investors. We decided to sell the company.

To us, the case of CP All was clear-cut. In contrast, the situation regarding Adani Ports two years prior was more ambiguous. The company, part of the Adani Group led by billionaire founder Gautam Adani, is India’s largest port operator by volume and capacity. It added significant value to our portfolio during the nearly five years we held it, as we built a relationship with management and supported its efforts to improve its governance. In 2019, however, we observed management reversing some of its commitments to reduce related party transactions as the control structures at the group level became increasingly complex and opaque. We believe the Adani Group has helped create value for long-term investors, but repeated scandals since then have contributed to high volatility and drawn increased scrutiny from regulators. In hindsight, we believe we made the right call when we sold the company.

Optimizing the Trade-Offs

Devotees of widely held stock ownership may regard the preponderance of concentrated control structures in emerging markets as an inevitable consequence of investing in markets with distinct histories, cultures, and less developed industries and businesses. However, we prefer to look below the surface and appreciate the opportunities that some of the passionate, forward-looking members of this class of owners bring to their collective tables.

EM founder- and family-led companies encompass some of the most dynamic, stable, innovative, future-oriented businesses we hold. While investing in them necessitates ensuring that interests are genuinely aligned and control is not misused, it can bring distinct advantages. Evaluating and optimizing those trade-offs has become an integral part of our research in emerging markets and a central focus of our engagements.

It is all part of affirming our role as responsible stewards of client capital and our commitment to conducting thorough, often on-the-ground research to seek to ensure we invest in businesses that will offer the best wealth-creation opportunities for our clients.

1 FactSet and the composites for the Sands Capital Select Growth, Global Growth, Global Leaders, International Growth, International Leaders, Emerging Markets Growth, Technology Innovators, Global Focus, and Global Shariah strategies, as of December 31, 2024.

2 As illustrated in the accompanying chart, MSCI, FactSet, and Sands Capital research, as of December 31, 2024.

3 MSCI and Sands Capital research as of December 31, 2024.

4 MSCI, FactSet, and Sands Capital Research, as of December 31, 2024.

6 https://www.bain.com/insights/founder-led-companies-outperform-the-rest-heres-why-hbr/

7 https://ir.anta.com/en/about_bod.php

12 https://www.marketscreener.com/quote/stock/RAIA-DROGASIL-S-A-9668315/company/?utm_source=chatgpt.com

13 https://ir.rdsaude.com.br/corporate-governance?utm_source=chatgpt.com

Disclosures:

The views expressed are the opinion of Sands Capital and are not intended as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell any securities. The views expressed were current as of the date indicated and are subject to change.

This material may contain forward-looking statements, which are subject to uncertainty and contingencies outside of Sands Capital’s control. Readers should not place undue reliance upon these forward-looking statements. There is no guarantee that Sands Capital will meet its stated goals. Past performance is not indicative of future results.

All investments are subject to market risk, including the possible loss of principal. International investments can be riskier than US investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional and economic developments. Investments in emerging markets are subject to abrupt and severe price declines. The economic and political structures of developing nations, in most cases, do not compare favorably with the US or other developed countries in terms of wealth and stability, and their financial markets often lack liquidity. Because of this concentration in rapidly developing economies in a limited geographic area, the strategy involves a high degree of risk. In addition, the strategy is concentrated in a limited number of holdings. As a result, poor performance by a single large holding of the strategy would adversely affect its performance more than if the strategy were invested in a larger number of companies. The strategy’s growth investing style may become out of favor, which may result in periods of underperformance.

Differences in account size, timing of transactions, and market conditions prevailing at the time of investment may lead to different results, and clients may lose money. A company’s fundamentals or earnings growth is no guarantee that its share price will increase. Forward earnings projections are not predictors of stock price or investment performance, and do not represent past performance. Characteristics, sector (and regional, country, and industry, where applicable) exposure, and holdings information are subject to change and should not be considered as recommendations.

The specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. There is no assurance that any securities discussed will remain in the portfolio or that securities sold have not been repurchased. You should not assume that any investment is or will be profitable. A full list of public portfolio holdings, including their purchase dates, is available here.

As of February 28, 2025, Anta Sports Products, Raia Drogasil, and Titan were held across Sands Capital strategies. The companies were chosen based on an objective criteria. Anta, Raia Drogasil, and Titan are the longest-held family-owned businesses in the three largest geographies of the Emerging Markets Growth strategy. CP All, Adani Ports, and Tata Group are not held in any Sands Capital strategy.

This report is an example of the type of fundamental research Sands Capital conducts and, as such, contains the opinions and comments of Sands Capital at points in time. Additional or subsequent information may cause Sands Capital’s views to change. This report is not a complete analysis of all material facts and therefore is not a sufficient basis alone on which to base an investment decision. This material may include summaries and references to research notes, emails, conference calls, and meetings, and there is no guarantee or representation that this information is complete, current, or accurate. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy and is not a complete summary or statement of all available data. This report is for informational purposes only. This report represents proxy proposals reviewed by Sands Capital (“Sands Capital” or “the Firm”). Per Sands Capital’s Proxy Voting Policy, there may be situations in which the Firm may abstain from voting a particular proxy or proposal. Sands Capital’s Proxy Voting Policy found here.

Sands Capital regularly engages with the management teams and, if appropriate, board members of portfolio businesses to better understand each business’s long-term strategic vision and management of risks and opportunities, including those pertaining to environmental, social, and governance (ESG) matters. More information is available in the Sands Capital Engagement Policy Statement. To receive a complete list of company engagements for the prior twelve months please contact a member of the Client Relations Team at 703-562-4000.

Charts and graphs are presented for illustrative purposes only.

The MSCI Emerging Markets Index captures large- and mid-cap representation across 24 Emerging Markets (EM) countries. With 1,379 constituents, the index covers approximately 85 percent of the free float-adjusted market capitalization in each country. EM countries include Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

References to “we,” “us,” “our,” and “Sands Capital” refer collectively to Sands Capital Management, LLC, which provides investment advisory services with respect to Sands Capital’s public market investment strategies, and Sands Capital Ventures, LLC, which provides investment advisory services with respect to Sands Capital’s private market investment strategies, including the Global Innovation strategy, which is available only to qualified investors. As the context requires, the term “Sands Capital” may refer to such entities individually or collectively. As of October 1, 2021, the firm was redefined to be the combination of Sands Capital Management, LLC, and Sands Capital Ventures, LLC. The two investment advisers are combined to be one firm and are doing business as Sands Capital. Sands Capital operates as a distinct business organization, retains discretion over the assets between the two registered investment advisers, and has autonomy over the total investment decision-making process.

Information contained herein may be based on, or derived from, information provided by third parties. The accuracy of such information has not been independently verified and cannot be guaranteed. The information in this document speaks as of the date of this document or such earlier date as set out herein or as the context may require and may be subject to updating, completion, revision, and amendment. There will be no obligation to update any of the information or correct any inaccuracies contained herein.

Notice for non-US Investors.