Contributors

Related Articles

Indian businesses that are able to seize the country’s increased digital and physical connectivity to find innovative and cost-effective ways to fill the unmet or evolving demands could find long runways for growth and create long-term value for our clients.

Key Points

- India’s large domestic market, rapidly growing middle class, stable economy, and democratic governance make it one of the most promising structural growth opportunities in emerging markets.

- Technological advances and efforts to formalize the economy should support businesses that can tap growing demand from underserved populations.

- We believe select banking, healthcare, technology, and consumer goods businesses will offer long-term wealth-creation opportunities.

During our recent trips to India, we were struck by how much the country has changed since we first began traveling there more than a decade ago. The most startling changes were to the physical infrastructure and digital ecosystem.

When we first began our in-country research India had only about 70,000 kilometers of roadways in its international highway system, which was relatively small in terms of the country’s size. We talked about being on the road in India, which was a bit of a euphemism because it didn’t take long outside the airport to be on something that didn’t resemble the kind of road you would see in the United States. They were unmarked and unpaved.

Fast forward to our most recent trip. It was very, very different.

Over the past decade, the size of the Indian national highway system has doubled.1 To put this in context, road mileage has increased about 7 percent a year in the past 10 years, which dwarfs in scale and speed the growth of the interstate highway system authorized under President Dwight Eisenhower, which was built over three and a half decades in the United States.2

But it’s more than just roads; it’s port infrastructure, railways, and airports. Infrastructure is just one of the enabling industries we are excited about going forward. Better infrastructure reduces frictions for a variety of businesses, enabling growth and unclogging inflation-causing bottlenecks.

We are seeing an even faster pace of growth in India’s digital ecosystem. As of mid-2024, India had more than 650 million smartphone users and more than 950 million internet subscribers. The simultaneous development of physical and digital infrastructure—byproducts of pro-growth reform—is unlocking India’s economic potential. This widespread adoption has enabled ecommerce, telemedicine, and fintech growth.3

national highway network (km)

internet penetration (%)

These rapid changes that serve to connect people physically and digitally could profoundly affect industries and businesses. They should also improve the ease of doing business, which could help India’s economy continue to grow at a healthy pace with rates of inflation lower than those we saw when we began investing in the country more than 15 years ago.

India’s economy and industry structure have underpinned strong earnings growth relative to developed markets (ex-U.S.) and other emerging markets.

India's Earnings Growth Shows Relative Strength

12/31/12 - 12/31/24

Despite this rapid development, much of India’s economy remains informal, creating an opportunity for industry formalization and consolidation. All told, India is one of the most attractive places we have found growth businesses outside the United States.

We believe businesses that are able to seize this increased connectivity to find innovative and cost-effective ways to fill the unmet or evolving demands in the world’s most populous country could find long runways for growth and create long-term value for our clients.

Indeed, India’s potential has not gone unnoticed, especially by investors assessing its macroeconomic backdrop and perceived benefits from shifts in regional centers of influence.

India is not a new investment destination for us, however. We have been overweight to this country for years, given what we believe to be its potential relative to the world and especially relative to other emerging markets.

Emerging Markets Growth Active Weight vs. MSCI EM

12/31/12 - 12/31/24

Monitoring the Near Term

As we go to press, we are monitoring India’s near-term investment outlook, which has become more complicated. Valuations are high at a time when urban consumption is in the middle of a cyclical decline, public investment has plateaued, private investment is weakening, and global financial markets have tightened and pressured the Indian rupee….

Growing interest in India had pushed the MSCI India Index higher for decades to a record peak in September 2024 as investors moved to take advantage of India’s economic growth potential backed by supportive government policies. However, after reaching that peak, the market as measured by the MSCI India Index lost about 10 percent of its value through the end of 2024, following reports of decelerating economic indicators and weak corporate earnings. The rupee has followed a similar path, losing 2.5 percent against the U.S. dollar, which has further increased investor concerns.

We believe short-term market volatility in this environment may provide long-term, fundamentals-based investors with a compelling opportunity to add to or build their Indian positions. Beneath the top-line numbers, we see a more nuanced picture of the economy, with certain areas, such as robust rural demand and a dynamic service sector, reflecting growing economic activity. Strong ongoing growth in India’s manufacturing exports—particularly in high-value-added segments, such as electronics, semiconductors, and pharmaceuticals—further underscores the country’s evolving role in global supply chains. The investments made by the Indian government and private sector businesses over the last 10 years, we believe, have made the Indian economy resilient and cleared the path for long-term growth in almost all sectors of the economy.

Additionally, improvements in the country’s financial systems and increasing participation by domestic institutional investors have helped to reduce the impact of volatile foreign fund flows, showcasing the growing depth and stability of India’s financial ecosystem. This shift reflects confidence in India’s favorable demographics and the rising wealth of its middle class, which are fueling consumption and also enhancing financial market stability.

We will continue to monitor the government’s ability to sustain and accelerate growth. A greater focus on channeling household savings into capital markets, bolstering domestic investments, and addressing restrictive trade regulations will, in our view, be critical to achieving this growth. Investments in digital infrastructure and incentives for fintech innovation are equally critical to maintaining momentum.

Why Does India Stand Out in the Universe of Emerging Markets?

India has about 1.4 billion people spread over an area about one-third the size of the United States. Its economy is growing fast—about 6.7 percent per year—at a pace that’s the fastest of the G20 group of leading rich and developing nations.

Much of India’s growth story began in 1991 when the government introduced a series of structural reforms after a balance-of-payments crisis. Deregulation and privatization followed. Trade and import restrictions were lifted; financial sector reforms began; the currency was devalued to make Indian exports more competitive abroad; and the country opened its doors to foreign direct investment. These reforms set the stage for India’s rapid economic growth, the emergence of the information technology and software sectors, the country’s integration into the global economy, and the creation of jobs that lifted millions out of poverty.

Prime Minister Narendra Modi, who swept to power about a decade ago, accelerated those reforms, promising to transform India’s economy from rural to industrial. His policies have supported continued economic growth and physical and digital infrastructure development. These have been critical to the free flow of people and goods, unlocking the country’s vast consumption and export capabilities.

Modi’s efforts to formalize the economy have helped boost government revenue, improve transparency, increase worker protections, and stimulate growth.

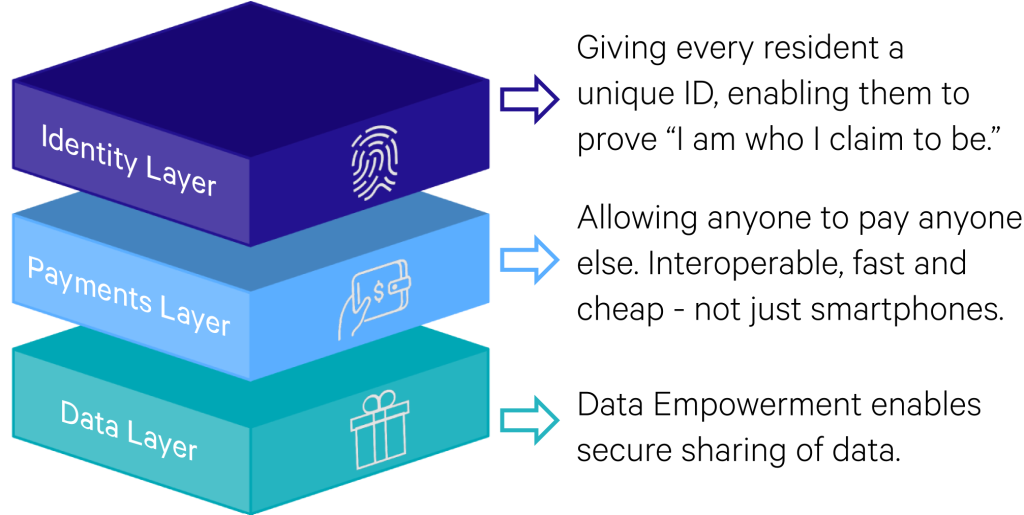

The so-called India Stack has been critical to Modi’s efforts. This set of application programming interfaces allows third parties to develop software that can access government IDs, payment networks, and user data. Through its digital platforms, such as the Unified Payments Interface (UPI), this stack has created the framework for Modi’s efforts to bring more Indians into the financial system.

India stack

In fact, over the past decade, some 530 million Indians—38 percent of the population—opened bank accounts, paving the way for greater financial inclusion through access to digital networks.4

Two other Modi policies that played an essential role in spurring growth and driving the formalization of India’s economy were demonetization efforts and goods and service (GST) tax reform. In 2016, the Modi government removed 86 percent of the country’s currency in circulation to prevent tax avoidance, combat the vast amount of counterfeit currency floating around India, and prod consumers into bank accounts.5

The following year, the government pursued aggressive GST reforms, replacing many separate taxes—such as excise duty, sales tax, and value-added tax—with a tiered GST. Consumers and businesses were forced into tax compliance, and as a result, direct taxation revenues surged 182 percent in the last decade.6 Significantly, since launching GST reforms, India has steadily advanced up the World Bank’s Ease of Doing Business rankings from 142 in 2014 to 63 in 2020, the most recent figures available.7

India’s economy is growing fast—about 6.7 percent per year—at a pace that’s the fastest of the G20 group of leading rich and developing nations.

Under Modi’s pro-growth reforms, the economy has grown 7 percent yearly since 2021. That is faster than the average 4.2 percent growth rate experienced across emerging markets over the same period. 8 That pace is expected to continue as the economy formalizes and India’s middle class—about 31 percent of the population today—potentially grows to 60 percent of the population by 2047, as suggested by ICE 360° surveys.9

As Indians grow more affluent, their spending patterns have changed. Recent household consumption surveys showed that, for the first time, Indians are spending more on consumer durables, such as televisions and refrigerators, than food, meaning they are increasingly focusing on wants rather than needs.10

food industry & consumption

From food retail to fast-moving consumer goods, India has ample room to grow from industry formalization.

This backdrop helps make India one of emerging markets’ most promising structural growth opportunities. We expect the country’s young population, expanding middle class, and the continued formalization of the economy to support that growth. We see opportunities arising as modern grocery and department stores replace mom-and-pop stores; banks offer greater access to financial services through digital options; and private medical services tackle unmet healthcare needs, especially among India’s rural poor.

Immutable Forces at Play

Digital Revolution

India’s digital revolution, which was enabled by the creation of the India Stack, has, in many ways, set the standard for emerging markets. It paved the way for the Indian government and businesses to begin to tackle the massive divide between rich and poor and to better serve the rural population, which makes up more than 60 percent of the population. Despite the significant advances, India’s digital divide persists, affecting access to financial services, healthcare, and education. Most recent statistics show that about 30 percent of the population has poor or no connectivity to digital services, and 47 percent of the rural population still lacks access to basic financial products.11 India’s central and state governments, as well as private companies, are actively working to fix the digital infrastructure imbalance. We see many potential opportunities in the electrification of rural India and, more broadly, the ongoing development of digital infrastructure, such as data centers.

The Digitalization of the Financial Revolution

India’s unmet needs offer long-term growth opportunities for businesses that are able to meet them.

The digitalization of financial services in emerging markets has begun opening the way to greater, cheaper, and more convenient access to banking services. We believe this is one of the most exciting investment opportunities we’ve seen in recent years, with long runways for growth, in part because of the large segments of the population, especially in rural areas, that remain unbanked. In our view, financial services businesses that create services and products to convert new consumers and merchants could see long runways for growth.

Banking

Most deposits in India remain in public-sector banks, providing share-gain opportunities for innovative private-sector financial services providers.

Similarly, businesses that offer advanced digital banking solutions that better address evolving consumer preferences, especially those of the younger customers, should benefit more than some of the older, more established financial services institutions as this demographic rapidly expands and seeks new solutions.

The introduction of the above-mentioned UPI has been critical to accelerating financial inclusion and digital commerce. By offering a free platform for merchants and consumers, UPI eliminates traditional barriers to entry, making digital transactions accessible to a broader audience. Its interoperable apps ensure that users can easily engage with the system regardless of their preferred application. This widespread acceptance—essentially by anyone with a mobile device—coupled with instant transactions that eliminate settlement delays empowers merchants to receive payments instantaneously. UPI streamlines the payment landscape, encouraging more participants to join the digital marketplace, and offers an alternative to the credit and debit card systems that impose fees on merchants and require approval processes. As a result, cash transactions in India have been declining sharply, according to data published by the Royal Bank of India.12

We must remain selective while keeping in mind the growth potential of the businesses in which we choose to invest, ensuring that they are backed not just by macroeconomic fundamentals but also by strong secular tailwinds.

However, according to a 2021 World Bank study, 22 percent of India’s population is still unbanked, which suggests an extensive opportunity for growth in digital payments. Moreover, according to the same study, only 35 percent of Indians use digital payment systems—far below the emerging markets average of 57 percent. That suggests a long-term growth opportunity for businesses such as Bajaj Finance that can take market share as more Indians take advantage of the UPI system.

Bajaj Finance, founded in 2007, is one of India’s leading nonbanking financial companies. It’s established a significant presence across India with a vast network of branches and a growing customer base. It has used its established customer relationships, brand credibility, and knowledge in product distribution to build and expand its digital capabilities, not only creating another driver of growth but helping to ensure that it will remain competitive in a rapidly changing digital landscape.

Bajaj Finance’s success in launching a consumer-facing application and web platform that includes end-to-end journeys for lending, investment, and insurance products has paved the way for more products. As of September 30, 2024, its app achieved nearly 62 million downloads, underscoring the large growth opportunity as its issuance of equated monthly installments cards, credit cards, loans, and insurance policies exceeded the company’s annual targets.13 We expect the ability to enable a seamless customer experience through online applications and quick approvals could help the company reach management’s goals of 38 percent annual growth in app installations, a 73 percent rise in UPI handles, and a 58 percent increase in point-of-service merchant locations on a year-over-year basis through the first half of 2025.

Aspirational Middle Class

The growth of the Indian middle class and its increasing disposable income have opened the way for premium and luxury goods makers. Titan, the country’s largest jewelry and watch retailer, has seized this wave of purchasing power to establish itself as a dominant force in a growing industry that has long been the domain of regional mom-and-pop shops.

Disrupting the Indian gold market is no small feat. Gold has immense cultural significance in India, where it is worn and gifted during religious festivals and ceremonies and has been considered a symbol of financial stability and security—not only as a way to store wealth but as a way to pass it to future generations.

Indians account for about 25 percent of global gold demand, surpassing the combined demand from the United States, Europe, the Middle East, and all of Asia (excluding China). We believe that breaking into this market can offer enormous upside for Titan. However, to do so, Titan has to find a way to deliver better quality products faster and at competitive prices while maintaining the look and feel of a neighborhood jeweler. Because of the cultural significance of jewelry, trust is critical. Indian jewelry consumers tend to have generations-long relationships with small shops and have relied on them to provide quality gold in products that meet regional tastes. To make inroads, Titan is trying to replicate these local tastes by hiring regional artisans with deep experience in local styles and tastes.

Scale matters as Titan tries to achieve these goals. Bringing everything from manufacturing to regional styling under one roof enables Titan to handle the volumes and absorb inventory costs better than the smaller mom-and-pop jewelers, who often struggle to compete in an arena in which gold prices soar and inventory turnover can be sluggish. Its scale advantages also allow it to offer quality and price guarantees that are often impossible for smaller shops.

Part of Titan’s strategy is to offer products at various price points through its brands. The flagship jewelry brand, Tanishq, targets upper-middle-class consumers, accounting for about 80 percent of sales, while Zoya and Mia aim at entry-level and ultra-premium markets. Most recently, Titan purchased CaratLane, an online jeweler, which should help Titan increase its market presence and national reach. While Indian customers used to rely on visiting a small shop to see if any piece caught their attention, today’s digital revolution has led customers to begin their searches online, a service Titan now provides.

Titan has also established itself as a leader in the recycled gold market, which accounts for about 40 percent of the country’s $1 trillion store of gold. Customers often bring gold pieces they no longer like to jewelers who melt them down and recraft them into something that is perhaps considered more stylish. Titan has seized market share not only by offering consumers more styles for their recycled gold but also by providing customers with a way to test the carat quality of gold. This service has helped Titan earn the trust of its clients in this competitive industry in which smaller shops have a history of selling pieces that do not contain the advertised amount of gold.

While still controlling only 8 percent of the market, Titan now operates more than 2,000 stores. We expect the business to increase its market share to 12 percent to 15 percent over the decade.

Increasing Healthcare Demand

The demand for high-quality and accessible healthcare is on the rise in India, fueled by a rapidly growing elderly population, which currently stands at 10.5 percent and is expected to top 20 percent by 2050.14 This demographic shift, coupled with a rising prevalence of chronic diseases such as cancer and diabetes, is intensifying the call for better healthcare solutions.

In this dynamic landscape, Apollo Hospitals has emerged as a frontrunner. Established in 1983 by Dr. Prathap C. Reddy as India’s first private hospital chain, Apollo has created one of Asia’s largest hospital networks and the largest pharmacy network in India.15

With a renowned brand and a demonstrated ability to deliver complex clinical care at scale, Apollo has effectively capitalized on its first-mover advantage and scale to set itself apart from competitors.

In the last 10 years, Apollo has expanded its hospital bed capacity by approximately 37 percent to just about 8,000 beds nationwide and its average revenue per operating bed by about 2.5 times. In October 2024, the firm reaffirmed plans to add another 2,800 beds nationwide. During the same period, Apollo expanded its retail pharmacy store network by about 3.7 times to some 6,000 stores.

When we first bought Apollo in 2012 pharmacy profit contributions were negligible to the overall business, which was still heavily in investment mode. Today, standalone physical pharmacies represent about 20 percent of total EBITDA.

Healthcare

India faces a significant shortfall in hospital bed capacity, relative to its population size.

More recently, the company has been taking part of its cash flows from its hospital and pharmacy businesses to invest in building the so-called third leg of its stool—its digital health business, which we believe should begin to convert current losses as it increases margins.

The digital health business has been able to leverage Apollo’s existing base of human capital—the leading physician network—as well as its physical assets—the country’s largest hospital and pharmacy networks.16

We expect the company’s efforts to expand its services to include outpatient surgery centers, create more retail pharmacies, and enhance its online pharmacy operation will create new avenues for future growth. The firm is also looking to expand its telemedicine capabilities on the back of India’s digital evolution. We anticipate that Apollo’s innovative approach will continue to drive above-average earnings growth for the next five years and beyond.

Finding the Needles in the Haystack

India’s economic and industrial landscape had underpinned its stock market’s decadeslong gains and outperformance relative to developed and other emerging markets. We believe it will do so again.

However, not all businesses will benefit equally from the transformative secular changes that have driven and continue to drive growth. Our significant time in the country and bottom-up research into Indian companies and their potential has enabled us to identify businesses—such as Bajaj Finance, Titan, and Apollo—that have been able to seize the potential of these transformative changes. We believe they are among the small group of businesses that will help create value for our clients over time. Moving forward, we will continue to assess infrastructure and industrial sector opportunities that we believe benefit from India’s growing demand for connecting people, goods, and services. We’re also seeing opportunities in new digital-first brands and digital services that benefit from and lead a meaningful change in consumer behavior in India. Indians are getting wealthier, but the services and goods they choose to buy may be significantly different going forward than in the past.

As we assess the landscape, we are well aware that the valuations of many Indian businesses are high relative to those in many emerging markets. Indian stocks (as measured by the MSCI India Index) traded at nearly double the 12-month forward price-to-earnings (P/E) ratio of broader emerging market stocks (as measured by the MSCI Emerging Markets Index), at 22-times versus 12 times earnings. However, we believe that high valuations are justified for select businesses supported by powerful secular trends.

MSCI INDIA CONSTITUENT RETURN DECOMPOSITION 12/31/13 - 12/31/24

As a result, we must remain selective while keeping in mind the growth potential of the businesses in which we choose to invest, ensuring that they are backed not just by macroeconomic fundamentals but also by strong secular tailwinds.

And, of course, we will continue to assess the country’s macroeconomic backdrop. We are encouraged by the resilience that India’s economy and businesses have shown in the face of global uncertainties and internal challenges. With robust rural demand, a dynamic services sector, and emerging leadership in high-value manufacturing exports, the foundations for sustainable economic growth remain intact.

We believe the investment case for our businesses also remains intact, supported by the country’s online digital revolution, its ever-expanding and aspiring middle class, and the move toward the formalization and expansion of services and markets.

1 https://pib.gov.in/PressNoteDetails.aspx?NoteId=151963&ModuleId=3®=3&lang=1

2 https://pib.gov.in/PressNoteDetails.aspx?NoteId=151963&ModuleId=3®=3&lang=1; https://web.archive.org/web/20071204072603/http://www.dot.state.mn.us/interstate50/50facts.html

3 https://www.trade.gov/country-commercial-guides/india-digital-economy

4 https://pib.gov.in/PressReleasePage.aspx?PRID=2049231

7 https://archive.doingbusiness.org/en/rankings https://www.indianembassynetherlands.gov.in/page/ease-of-doing-business-in-india/

8 https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD/MEQ

9 https://www.price360.in/expertview/the-rise-of-indias-middle-class-a-force-to-reckon-with/

12 https://m.rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=22933

14 https://india.unfpa.org/en/news/india-ageing-elderly-make-20-population-2050-unfpa-report

15 https://www.statista.com/statistics/1318770/india-number-of-stores-of-pharmacy-chains-by-company/

16 As measured by numbers of hospital beds and pharmacies.

Disclosures:

The views expressed are the opinion of Sands Capital and are not intended as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell any securities. The views expressed were current as of the date indicated and are subject to change.

This material may contain forward-looking statements, which are subject to uncertainty and contingencies outside of Sands Capital’s control. Readers should not place undue reliance upon these forward-looking statements. There is no guarantee that Sands Capital will meet its stated goals. Past performance is not indicative of future results.

All investments are subject to market risk, including the possible loss of principal. International investments can be riskier than US investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional and economic developments. Investments in emerging markets are subject to abrupt and severe price declines. The economic and political structures of developing nations, in most cases, do not compare favorably with the US or other developed countries in terms of wealth and stability, and their financial markets often lack liquidity. Because of this concentration in rapidly developing economies in a limited geographic area, the strategy involves a high degree of risk. In addition, the strategy is concentrated in a limited number of holdings. As a result, poor performance by a single large holding of the strategy would adversely affect its performance more than if the strategy were invested in a larger number of companies. The strategy’s growth investing style may become out of favor, which may result in periods of underperformance.

Differences in account size, timing of transactions, and market conditions prevailing at the time of investment may lead to different results, and clients may lose money. A company’s fundamentals or earnings growth is no guarantee that its share price will increase. Forward earnings projections are not predictors of stock price or investment performance, and do not represent past performance. Characteristics, sector (and regional, country, and industry, where applicable) exposure, and holdings information are subject to change and should not be considered as recommendations.

The specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. There is no assurance that any securities discussed will remain in the portfolio or that securities sold have not been repurchased. You should not assume that any investment is or will be profitable. A full list of public portfolio holdings, including their purchase dates, is available here.

As of January 30, 2024, Apollo Hospitals, Bajaj Finance, and Titan were held across Sands Capital strategies. The companies represent our largest Indian holdings in healthcare, financial services, and consumer goods and were selected by the authors on an objective basis to illustrate the views expressed in the commentary.

The MSCI India Index is designed to measure the performance of the large- and mid-cap segments of the Indian market. The index covers approximately 85 percent of the Indian equity universe.

The MSCI Emerging Markets Index captures large- and mid-cap representation across 24 Emerging Markets (EM) countries. With 1,379 constituents, the index covers approximately 85 percent of the free float-adjusted market capitalization in each country. EM countries include Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

The MSCI EAFE Index is an equity index that captures large- and mid-cap representation across 21 Developed Markets (DM) countries around the world, excluding the United States and Canada.*

*DM countries in the MSCI EAFE Index include Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the UK. EM countries include Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

Charts and graphs are presented for illustrative purposes only.

References to “we,” “us,” “our,” and “Sands Capital” refer collectively to Sands Capital Management, LLC, which provides investment advisory services with respect to Sands Capital’s public market investment strategies, and Sands Capital Ventures, LLC, which provides investment advisory services with respect to Sands Capital’s private market investment strategies, including the Global Innovation strategy, which is available only to qualified investors. As the context requires, the term “Sands Capital” may refer to such entities individually or collectively. As of October 1, 2021, the firm was redefined to be the combination of Sands Capital Management, LLC, and Sands Capital Ventures, LLC. The two investment advisers are combined to be one firm and are doing business as Sands Capital. Sands Capital operates as a distinct business organization, retains discretion over the assets between the two registered investment advisers, and has autonomy over the total investment decision-making process.

Information contained herein may be based on, or derived from, information provided by third parties. The accuracy of such information has not been independently verified and cannot be guaranteed. The information in this document speaks as of the date of this document or such earlier date as set out herein or as the context may require and may be subject to updating, completion, revision, and amendment. There will be no obligation to update any of the information or correct any inaccuracies contained herein.

Notice for non-US Investors.