Kevin Murphy (00:01)

Welcome to What Matters Most, Sands Capital’s podcast series in which we explore some of the trends in businesses that are propelling the pace of global innovation and changing the way we live and work today and into the future.

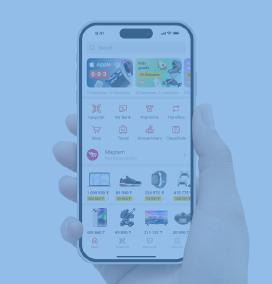

Today we’re chatting with Research Analyst Brian Crofton about a business that you may not have heard of unless you are totally tuned into the IPO [initial public offering] market or routinely do business in Kazakhstan. But if you do, you would know that Kaspi is the leading digital financial services company operating Kazakhstan’s largest consumer finance business, payments provider, and ecommerce platform. Kaspi operates what is known as a super app in much the same way that some more familiar businesses like Tencent do, creating an ecosystem of interrelated services that drive engagement and encourage cross-selling among products.

It’s been a while since we’ve delved into any fintech business on this podcast, so we’ll make sure to set up the landscape here before we dive deeply into how this company operates and why we made the investment in Kaspi.

Thanks so much for being here today, Brian. You’re well positioned to give us some great insights into this business, having done the initial research and written the investment case for Sands Capital back in 2020, in addition to your coverage of similar businesses in this space. So I’m very excited to get into this with you.

Brian Crofton (01:20)

Yes, thank you for having me. I’m looking forward to talking about Kazakhstan and super apps.

Kevin Murphy (01:24)

Great, and I’m sure we’ll go well beyond that because this is a business that’s not without some interesting caveats, in particular, given its geographic location in Kazakhstan. To my knowledge, and I’m 100 percent sure I’m right on this, we’ve never owned a business domiciled in Kazakhstan before. So this will be an interesting angle to tackle as well.

Typically, we would start with kind of the backdrop on fintech generally. And fintech, I think, is kind of an overused term. We’ll throw it out a lot here on this podcast, I’m sure. But correct me if you would rather call it a financial services business, a financial platform, digital financial, or whatever you want to call it.

Why don’t we start—instead of just the broad view of fintech or financial services—and maybe give us a walk through that landscape through the lens of Kaspi. Where did it start? What were its origins? How did it evolve? And what does it look like today?

Brian Crofton (02:18)

Yes, absolutely. So you know, we can call it a fintech, but I think it’ll be clear. It’s actually a lot more than just a fintech business. But yes, going back to 2007 is when the story started. Back then, Kaspi was a, you know, a Kazakh-focused commercial bank, actually, lending to large corporates and SMEs [small and medium enterprises] and these types of things.

In 2007, something interesting happened, which was a Russian private equity fund and a large local businessman got together and bought this business. And what they did with Kaspi is they converted it first from a commercial bank into a retail bank, and then from the retail bank into a purely digital banking financial institution. And then from there, what they’ve done over really the last 10 years now is to expand beyond just digital banking into payments, into ecommerce, and into a long list of auxiliary services. And really what you have today now for Kaspi is a comprehensive super app, which, similar to—fintech, is an overused term, but I think that Kaspi really fits that definition quite aptly relative to some of the other businesses we’ve looked at. So really what you have now is an interrelated platform of ecommerce, which is facilitated by a proprietary payments network. And then you have consumer loans, which then fund those transactions. And all of this interrelates and drives further synergies across this platform.

Kevin Murphy (03:41)

So let’s define some terms here. When you say digital banking, what do you mean by that? Are we talking about just traditional banking now in a digital format or are there nuances to it?

Brian Crofton (03:51)

That’s a great question. So it’s traditional banking in the sense that they give out loans and they take in deposits, but there are no branches associated with this. And there is, all of this is done through a mobile interface, and it’s done principally through data collected over this digital platform. And so, they’re using payments data, they’re using the credit bureau data, they’re using interactions on the ecommerce platform, they’re using that type of data to inform the underwriting decisions in a more sophisticated way than a traditional bank and definitely your average Kazakh bank would be doing otherwise.

Kevin Murphy (04:25)

Got it. So you know, in that digital finance space and consumer finance, in particular, would you consider the brick-and-mortar banks to be their competitors then?

Brian Crofton (04:36)

Yes, I would. I would say their main competitors, I mean, let me back up here. Kaspi, they do these three big segments, and so they have different competitors across these segments. But I would definitely point to the other retail banks. There’s one large one called Halyk Bank. It’s a state-owned bank. That’s their main competitor on the banking and payments side of the equation. And then within the ecommerce side, you actually have AliExpress coming from Alibaba in China as the main competitor within ecommerce.

But, you know, really more broadly, their main competitor is cash transactions, is local mom and pop stores, is the lack of access to credit. Kaspi is first and foremost a story of driving penetration in a very underpenetrated market, more so than it is a competitive share game story.

Kevin Murphy (05:25)

OK, excellent. Well, we kind of started already digging into the specifics of Kaspi’s business. Why don’t we continue along that path? Tell us, you mentioned three different lines of business. Maybe talk to us about each of those and what their advantages are in those particular spaces. I think it’d also be interesting to talk about competitors in the ecommerce and payments platforms as well.

Brian Crofton (05:44)

Yes, absolutely. So I’ll start with payments. And the reason I’ll do so is even though that’s not where Kaspi the business began, when you talk to management today, they first and foremost think of themselves as a payments business that is layering use cases onto this network, which is an interesting way to think about the business. And we can talk more about that.

But within payments, they do the full value chain here, which is unusual, I would say, for a business of this type. So they’re on the issuance side, they provide debit cards and QR codes for consumers. They do the actual network, so they’ve replaced Visa in Kazakhstan by and large. Visa has a small presence there, but most of it’s Kaspi. And then they are on the acquiring side, so they provide the POS [point-of-sale] devices and the payment gateways for merchants on the offline and online space, respectively. And so, start to finish, Kaspi is the predominant payment network and provider in Kazakhstan today. Mostly on QR, a little bit on card.

Moving on to the ecommerce space, which is the primary use case for that payment network, they have a traditional 3P [third-party] marketplace. So Kaspi, they don’t provide any of their own inventory, they’re simply connecting merchants with consumers and taking a cut of that while providing their own logistics and fulfillment capabilities and an ad service that is layered on top of that platform.

They also, as a portion of that broader ecommerce segment, they actually do something that they call mcommerce [short for mobile commerce], And that is really a digital online-to-offline network that connects consumers with small local service providers, such as barbers or salons, these types of businesses. So you have two different ecommerce platforms operating in that segment.

And then, lastly, you have the retail banking or the consumer banking space. And that’s where you get

buy now pay later loans, general purpose personal loans, and even auto loans. And then they’ve begun to scale SME loans that tie back to their ecommerce partners over time. And so, that’s the lay of the land for the core segments today.

Kevin Murphy (07:49)

OK, excellent. And just so people understand, 3P is “third party.” And there are some advantages to not holding inventory and not running logistics.

Brian Crofton (08:00)

Yes, I mean, Kaspi is, they take quite seriously this idea of being an asset-light business. So, as we’ve spoken about before, the digital bank, they have no branches there. So it’s very asset-light on the banking side. Payments is inherently a pretty asset-light business. Typically, you have some POS devices, you have some technology infrastructure.

But on the ecommerce side of things, you’re right, they hold no inventory. They do operate fulfillment centers, and so that requires some capex [capital expenditures], some assets. But then even the actual delivery of these packages is done through third-party couriers. So they have about 50 partners that are local delivery services in Kazakhstan that they work with. And they provide the technology. They even have their own app for these couriers, but they are not employees of Kaspi, and Kaspi itself does not own the trucks. They don’t own the actual network at all.

That all enables this business to generate extremely high margins, extremely high return on cash, and generate just a ton of free cash flow.

Kevin Murphy (09:00)

OK, so it sounds like a very powerful business model. And, in isolation, very synergistic across what it does. It seems like a great business. Now, let’s plop it into Kazakhstan. Is that, give us kind of the lay of the land. Why is that a good environment to do business? And why is this a good investment in that area?

Brian Crofton (09:17)

Yes, that’s a great question. I mean, the story so far, it sounds almost too good to be true, right? And then the question is, why does a business like this growing at 30 percent plus earnings with a net income margin that’s over 40 percent trade in a high single digits, NTMPE [next 12 months price/earnings] multiple? And the answer is it’s Kazakhstan, right? It’s the macroeconomic risk. It’s a mix of unfamiliarity and real on-the-ground risks that you need to be comfortable with as investors in this business.

So I have to admit, before we started digging into Kaspi as a potential investment, I didn’t know very much about Kazakhstan. This was a learning process in 2020 when the business first came across our desk. I didn’t work on it by myself. We brought in the emerging markets PMs [portfolio managers]. We brought in several other analysts who are focused on, or at least spent time doing macro research, especially a few analysts who worked a lot in Russia, where there are a lot of parallels with Kazakhstan. So I have to shout out Eric Black as being an analyst who helped a lot on this part of the work.

And really what we learned was that Kazakhstan, it’s not the best macro environment that we’ve invested in here at Sands Capital, but, to some extent, it is an underrated macroeconomic environment, based off what we were expecting.

And so let me offer you a few data points here. Over the last 20 years, the Kazakh economy in real terms

has grown GDP [gross domestic product] by an average of 5 percent based on the World Bank data. From the UN [United Nations], the Kazakhstan population ranks in the very highest category on the Human Development Index, which takes into account life expectancy, education, and income. And from a GDP per capita perspective, Kazakhstan ranks in line with Mexico, Turkey, and Russia—and above that of Brazil. And so this is not a country that doesn’t have a few things that are going for it. That is not purely unattractive.

On the other side of the ledger, the country has a high degree of dependency on oil exports. It’s a majority of exports, and it’s also a high portion of overall GDP contribution. In addition to that, during periods of weak commodity prices like we saw in 2014 to 2016, you do have some FX [foreign exchange] weakness. Kazakhstan was able to avoid that to some extent during that past period because they had a large amount of central bank reserves to defend the currency.

Moving forward to today, those reserves have diminished. And so in the event that oil prices do decline substantially for a long period of time, that does place additional pressure on the currency. What we’ve seen is over the last five years, an FX depreciation of about 5 percent, and over the last 10 years, including that period of 2014 to 2016, closer to a 10 percent annual depreciation. So this is a meaningful headwind to any investment in the .

Partially offsetting those two things is the fact that overall debt, especially foreign debt, remains contained, and the sovereign wealth fund that holds all of the savings for Kazakhstan has a long-standing practice of defending the currency as well. So you can’t just look at central bank reserves when thinking about the defensibility of the tenge, the currency in Kazakhstan.

So what does this all mean? If you roll up these positives and negatives, what you have is a country that

is growing pretty well, has a population that is seeing rising incomes, is well educated but is dependent on commodities, specifically oil, to fund that growth over time. And so there is a real risk to the FX, and you need to expect further depreciation in the currency for any investment in Kazakhstan.

And so when you think about Kaspi as a holding at Sands Capital, we need to hold it to that standard where the expected returns on a risk-adjusted basis need to be able to remain attractive even in a scenario where FX depreciation is substantial. And so the way I model it is: I look at what would expected returns be if FX depreciated 5 percent a year, 10 percent a year, 15 percent a year. As long as those numbers come back attractive relative to the rest of the portfolio, then Kaspi does still remain a very attractive opportunity. The moment it falls below some of those thresholds, we need to reassess whether or not that macro risk overwhelms the benefits of the actual business.

Kevin Murphy (13:53)

Let’s break that down then into the specific business lines. Just let me see if I can sum this up. On the payment side, transaction volumes are probably one of the key drivers there. Maybe ad valorem pricing based on not just the volume but the value that’s being moved around. On the fintech side, it’s a consumer lending business plus. So net interest margin, I’m guessing is one of the key

metrics there, and you’ve got to think about interest rates and the long-term projection for rates in that area. And then on the ecommerce side, it’s affluence, growing affluence—very simply put, people buying more stuff generally.

Can you walk us through each of those, not in a ton of detail, but tell me what are the risks? What are the kind of impacts you would see on each of those business lines should oil drop or interest rates change dramatically?

Brian Crofton (14:46)

Yes. So starting with payments, you’re totally right. The principal earnings for the payment segment come from a percentage of the transaction value flowing through this network. So as of today, the average user of Kaspi uses the Kaspi payment network two times a day. That’s pretty high. If the price of oil was to drop precipitously and economic activity was to slow in Kazakhstan, you would see that hit the payments network through lower consumption and, specifically, lower ticket sizes, presumably, as people begin to trade down. There would be a headwind there, right?

On ecommerce, I would say similarly, right? They get a take rate for the amount of consumption taking place as a percentage of gross value going through the ecommerce platform. If people begin to consume less, it’s the same logic, right?

And then lastly, on the consumer credit, you have the two full considerations of asset quality or delinquencies may rise as the economic position of their customers deteriorates, and you may have a spike there.

And then on the lending side, it could kind of be a plus or a minus, right? On the positive side, if people are facing a cash crunch, they may turn to credit as a way to bridge that gap. On the negative side, Kaspi may not be comfortable lending to some of those people based off of their new income position, and you will likely see a pullback in credit nonetheless. And so overall, it is the case that, in an absolute sense, if economic activity slows from lower oil prices in Kazakhstan, you’d see a slowdown in Kaspi’s business activity.

What gives me comfort with all of this, though, is the overall penetration rate of these services. So without getting too in the weeds here, the punch line is all three of these services remain very early in their penetration cycle in Kazakhstan. And so even if you have an overall pie that’s no longer growing at the same pace or even shrinking, Kaspi’s slice of that pie is still going to keep expanding.

I’ll give you a few numbers that demonstrate this point. Within payments, overall penetration of digital payments is less than a quarter of that of China or the U.S. today. In ecommerce, it’s similarly well below one-third of what you see in the U.S., Russia, or China. And retail credit, it’s the same story with China, Brazil, the U.S., and even Russia being well above retail credit penetration compared to Kazakhstan. And these numbers all come from a combination of the Euromonitor [International] and the Kazakh government data to give you a sense of that scale here. And so what I’m trying to say is that there’s easily space for penetration across all three of Kaspi’s segments to at least double over the next five and 10 years, conservatively. I think looking at, you know, even further growth down the line is quite possible, especially when you consider that you have a business like Kaspi driving that penetration. This is not a country where you don’t have clear digital platforms taking shape and developing. You already have a best-in-class internet platform that is pushing adoption across all three of these. And so, if anything, I would expect us to bridge this gap faster than you would in most countries that you’d want to compare with Kazakhstan too.

Kevin Murphy (18:03)

OK, excellent. But let’s move away from kind of the geopolitical and macroeconomic overhang and go more specifically into what makes this a special company besides the super app. Talk to us a little bit about some of the synergies across those three business lines, or if there are any, and why that matters.

Brian Crofton (18:19)

Yes, absolutely. And this is actually my favorite insight into Kaspi. I think it’s really a beautiful interrelated network that they’ve built here. And so starting with the ecommerce platform, I think really anchors a lot of this, and this is where you’ve seen the fastest growth. So I think it’s appropriate to start here.

Within ecommerce for Kaspi, you have your marketplace here. For a consumer to make a purchase through the ecommerce platform, you need to go through Kaspi’s payment net. Right? And so that any transaction that you engage on the ecommerce necessitates a payment through the payment network. The data then that is gathered from the ecommerce and the payments network go to inform credit underwriting for the banking business. That credit also stimulates more payment volume that goes through the network into the ecommerce. And the more transactions that are taking place over this network typically leads to an accumulation of excess cash on these digital wallets that is then pushed into deposit accounts. And so what you have is a payment network with a clear use case in the ecommerce segment that inherently facilitates each other and then you layer credit on top of that to juice overall volumes in the network in a way that encourages strong asset quality, increased volume, and thereby monetizes the same transaction a couple of different ways.

And thinking about it another way, if I was to take a buy now pay later loan from Kaspi and use it to buy a product on Kaspi’s ecommerce platform, I’ve actually paid Kaspi three times for one transaction. And so what this is allowing is for Kaspi to offer extremely attractive and relatively low prices for each one of these services, leaving consumers and other stakeholders pretty happy with the transactions. And nonetheless reaping a lot of monetary value out of that same, that one transaction.

Kevin Murphy (20:08)

OK, excellent.

Let’s talk then about some of the mechanics behind the business or the stock itself. As I mentioned at the beginning, if you’re following the IPO market, you may have heard of Kaspi because they’re one of the first companies to list in the U.S. this year to a lot of fanfare. I think people were introduced to the name that way, if you read the financial press. This will be a twofold question, you know,

Brian Crofton

Mm-hmm.

Kevin Murphy

Why they did that, what was the reason for moving into the U.S. exchange? And, two, just the general ownership of the company. Maybe comment on Baring Vostok and the ownership structure there, and what gives you comfort investing alongside that group.

Brian Crofton (20:47)

So the rationale for the listing here really stemmed from the fact that Kaspi originally listed in London back in 2020, that was the IPO that we participated in. And there has been a disappointing amount of liquidity. Those shares have not traded all that well. And you’ve only had about 20 percent of the float actually actively being traded. The rest of it’s locked up by these three insiders—the chairman, the CEO, and then this private equity fund Baring Vostok. And so this has been a point of engagement that we have leveled with the management team for quite a while now. I think, in our view, we’d like to see liquidity improve in this stock and hopefully would allow more investors to participate as shareholders in Kaspi. And some time after going through all of COVID-19, we were very pleased to see them actually respond to this engagement.

And they finally listed an IPO in New York earlier this year, as you mentioned. Really, the rationale for doing so was to release additional float and hopefully move shares into a market where you’d see higher volume being traded. So what they’re going to do is they’re going to decommission or shut down the GDR [global depositary receipt], and they’re going to transfer all of the volume, all the float, into the U.S. shares, hopefully doing two things. One, you’ll now have about 25 percent of the float as opposed to 20 percent earlier. And two, hopefully the volume of that float will be traded a little bit more actively and introduce new prospective shareholders in the U.S. to this business.

And so in our review, we’re quite positive on that as a potential opportunity for a rerating as more investors look at this business and get comfortable with the idea that you still have a business growing at very strong rates, very strong profitability, and really overall a business model that is familiar and quite impressive to a lot of investors. With the caveat being that Kazakhstan is not a macroeconomic environment most investors are used to or comfortable investing in.

is that this listing, and this is the view of management as well, potentially attracts new investors to take a look and give Kaspi a shot here. We’re trading at a high single-digit multiple, and for a business like this, in our view, it could potentially be a fair bit higher.

Kevin Murphy (23:09)

So in terms of Baring Vostok, I think one of the conditions of investing in emerging markets or frontier markets is you have to invest alongside certain partners. And they own, as you’ve said, a considerable amount of the business and the float. It is a U.K.-based private equity firm but certainly has deep roots in Russia. And I think there have been some headlines recently, again, this is brought by the Russian courts, but embezzlement charges against certain partners at Baring Vostok, I mean. How did you get comfortable with that? What’s your interaction with that group? Or is there any still?

Brian Crofton (23:44)

Yes, absolutely. So we’ve actually met with the founder of Baring Vostok. It’s true, you know, he has had some legal issues in Russia. I think the important point for us is really twofold. One, they’re not involved in the day-to-day operations. They’re based outside of Russia. And so an initial concern of ours was: Is there going to be a risk of sanctions, of assets being locked up? Is that going to cause any issues? We’re quite comfortable that it’s not going to be a problem—over two-thirds of their assets are outside of Russia. The firm is based in the U.K., as you mentioned. The founder is himself an American with an American passport. So while they are known for investing in Russia, the fund itself is not Russian, and it’s extremely unlikely it will be subject to any sanctions or other restrictions by Europe or the U.S. So that gave us a bit of comfort.

The relationship to Baring Vostok with Kaspi does go a level deeper, however. The current CEO and co-founder of this business is a former partner of Baring Vostok, and that’s really the connection. And so

Mikhail was a partner, he identified this business, he brought the idea of what Kaspi could be to Baring Vostok, and as part of that investment, Mikhail left to actually run the operations there with about a 25 percent stake in the business, with Baring Vostok taking another 25 percent stake. And so it’s been a long-term partner. It has been invested through this entire transformation. And it’s—one of its partners is, you know, an active co-founder. It’s definitely something that we needed to get comfortable with and we’ve done a lot of work digging into. I think the punchline for us is this is a private equity firm that has created a lot of value in coordination with one of its former partners and, having met with them, their intention is to remain invested for the long term of this business.

Kevin Murphy (25:38)

OK, so let’s stick on that topic of risks for a minute. Let’s talk about the company’s inner relationship and good relationship with the power structure within Kazakhstan.

Brian Crofton (25:48)

Yes, which is an important consideration, right? And we really looked at this along two frames. The first is the interpersonal between management and the government. And the second is more organizational, how Kaspi the business fits in with the government’s goals.

On the first part, it’s important to note that one of the co-founders of Kaspi, Mr. Kim, is a very successful businessman. He’s operating in Kazakhstan for many decades. He’s operated a successful IT [information technology] services company, as well as a very large electronics retail chainAnd one of his roles as chairman of Kaspi is to work closely with the government to make sure that the business is operating in line with the aims of the overall Kazakh administration.

And you can’t be in the room for those interactions. And so you need to assess the efficacy of that role based off of the outcomes, as well as a lot of experts and Kazakh watchers that we’ve spoken to in the past.

So really, I’d point to two key facts that give us some conviction that Kaspi is maintaining good relationships with the government. The first one is that the company has successfully navigated the transition from President Nazarbayev to President Tokayev over the last several years very smoothly, without any hiccups or challenges to business operations. That will always be a delicate transition of power. The fact that the company has been able to do so without any challenges does tell us that management is maintaining good relations across the board within the ruling class.

And then secondly, here is over the course of Kaspi’s now over 10 years of operation as a leading digital financial institution, they’ve competed directly with Halyk Bank, one of the large state-owned banks we mentioned earlier. And what’s notable is that several members of the government are either part of Halyk Bank or have family members that sit on the board of Halyk Bank.

And the fact that Kaspi has been able to effectively and successfully compete against Halyk Bank on a fair footing does tell us that the business is aligned and in the good graces of the power structure within Kazakhstan. Moving on to the actual business operations, Kaspi charges a very fair and low price for most of its services and that generates a lot of goodwill by regulators and other stakeholders.

And, secondly, the business also provides a lot of services for free on behalf of the government. And so for instance, you can renew your driver’s license, register your car, register a new business, pay some of your taxes, and even pay your fines and other tickets, all through the Kaspi app, all for free. And so the fact that Kaspi has been allowed to plug into the government systems in this way, and the fact that they provide these services to the government for free, also demonstrates that the company is aware of the alignment it needs to have with the government’s interests over time in order to continue to do what it’s doing. And we believe that management understands this. They’re very open about talking about it and so far have a track record of doing it successfully. And so this is always going to be a risk when you invest in a country like this, but we think it’s a contained risk, and we think that the business is doing everything it can in order to have that under control.

Kevin Murphy (28:56)

Let’s talk about Kazakhstan’s relationship and the power structure with the kind of elephant in the room, which is Russia. So Kazakhstan declared independence from the Soviet Union, and I think it was 1991, coincidentally, two years after Ukraine declared independence. So what is the relationship between Kazakhstan and the current Russian government? And then, I guess kind of the bigger question within the question: Is there any likelihood of kind of a similar attempt to repatriate Kazakhstan into, you know, the Russian Federation now.

Brian Crofton (29:28)

Yes, this is a question that’s kept us very busy over the last couple of years. And so I’m glad you asked. I think a few comments to make here. One, I think it’s well established that Kazakhstan has a close relationship to Russia. It’s a strategic relationship that dates back many decades at this point. President Tokayev himself has a close relationship with Putin. We believe that Putin has been supportive of Tokayev taking over after Nazarbayev. And so he does have support from the Russian state. With that said, Kazakhstan has maintained a certain distance with Russia over the last several years, particularly around preserving neutrality toward the war in Ukraine. This is something that has irked Russia, based on everything we’ve heard, but they’ve been allowed to continue to do so.

So what you have is a country that is independent but has close relations with Russia. What’s of note, though, is that Kazakhstan, you know, sits in a very strategically important location within Central Asia. They also have 40 percent—close to 40 percent—of the world’s uranium supply. And so Russia is not the only large country that is interested in cultivating ties with Kazakhstan. China also has developed, over time, a very close relationship with Kazakhstan.

Xi [Chinese president Xi Jinping] was just in Kazakhstan last year, shortly after Joe Biden, as a matter of fact, and Kazakhstan has been a recipient of a lot of [Chinese] Belt and Road [Initiative] support over time.

Lastly, Europe and the U.S. have also invested a lot in Kazakhstan. The U.S. is a leading source of FDI [foreign direct investment] for the country, and President Tokayev has cultivated that relationship as well.

It’s a strategically important country. It’s a large geographic space with important resources. And while they have very close, long-standing ties with Russia, that is not their only long-standing relationship in the region. And President Tokayev himself was previously the foreign secretary under President Nazarbayev, and everything that we’ve seen suggests that he’s been doing a good job of continuing to balance these interests as the country has been doing over the past 30-plus years.

So it’s definitely a risk we’re aware of, but it’s of note that sanctions against Russia have not expanded to Kazakhstan or related countries. Other than Belarus, really, none of these affiliated countries and CIS [Commonwealth of Independent States] have come out strongly in favor of Russia in the past several years. And lastly, as long as Kazakhstan remains close to Russia, we think that the risks of them sending troops in to assert control is relatively low. Russia did send in some troops early last year, I believe, to help quell some domestic unrest that took place during the transition of power from President Nazarbayev to President Tokayev. And so there is involvement there. But they were doing so in support of the government, not in contest of the government. We don’t think President Tokayev is going anywhere, based on all of our work. And so we think that, more or less, we’re seeing a status quo in these relationships.

Kevin Murphy (32:23)

Great. I know this is kind of a macro geopolitical heavy podcast, but it necessarily has to be, I think, because of the location. But maybe on that same thread, I know you helped through the early work on Nubank and are also involved in fintechs outside of this particular one.

Can you talk about how your approach to the research might be different? Is it informed by the geopolitics around it, or do you do that same level of scrutinizing work on all the companies, the geographies that they operate in, regardless of what that might be?

Brian Crofton (32:55)

I think it definitely influenced the research process. I think the context of when we discovered Kaspi was we were in the thick of preparing for the Ant Financial IPO. This was around the same time. And so when we started digging into Kaspi, we already had a lot of context on this very type of business model of the payments-based digital wallet with the lending, with other services layered on top of this, right, including ecommerce. And so the business model was quite—I don’t want to say straightforward, but we were very familiar with it. And we were able to use a lot of pattern recognition, both from Ant, as well as all the peers that we were looking at to help better understand that business. So we were able to move that knowledge over to Kaspi pretty quickly. And what we found was that this was a business that we were very interested in. I think the bottom-up research on the business was all very confirmatory in a relatively short order of time.

The big question was the macro risk and the Kazakh government risk. And so this was a bit of a different research process than we would use for something like {Brazil’s] Nubank, where Brazil is what it is. We’ve invested there for a very long time at this point, and we have macro frameworks built for that country for a while. And there, the question was more around do the unit economics of Nubank work? Can this business compete against the likes of [Banco] Itau and [Banco] Bradesco long term? Those types of questions.

With Kaspi, the competitive intensity is quite low. The business model was already more or less formed with proven unit economics by the time of the IPO. So a lot of those questions had been well addressed or didn’t take a lot of time to address. So you’re correct in thinking the research process was a bit different for Kaspi than it has been for other fintechs that we looked at.

Kevin Murphy (34:36)

And have you been to Kazakhstan? Have you had a chance to kind of explore the region?

Brian Crofton (34:39)

I, unfortunately, have not. Teeja Boye, one of the co-portfolio managers of Emerging Markets, was our emissary as the country opened up from COVID-19.

And we have a trip that’s in the works this year. So hopefully I’ll be able to come back to you with some more anecdotes next time we do a podcast.

Kevin Murphy (35:42)

And again, I probably read this somewhere, so I may be getting it wrong or slightly off. But in terms of expansion beyond Kazakhstan, am I correct that they’re in either Azerbaijan or Uzbekistan as well, or potentially moving into those areas? And is that part of the investment case?

Brian Crofton (35:57)

Yes, and this actually ties with the geopolitics question as well. So the setup for Kaspi here is, and let me just back up for a minute. Kaspi operates in a relatively small market. There are a little under 20 million people in Kazakhstan. The overall GDP is not enormous. And so when you have a company growing at this pace, it’s fair to worry at some point soon you will probably run out of headroom here to sustain that level of growth.

Kevin Murphy (36:23)

Twenty million total population, how many current downloads have there been? And then what’s the monthly active user picture look like? Because I think that’s a lot relative to the size of the country.

Brian Crofton (37:21)

Yes. So, out of a population of 20 million people, I think it’s closer to 19 million, but out of a population of 20 million, Kaspi has 14 million monthly active users. And of those, they have close to 70 percent daily active users. And so, it’s fair to say that the majority of Kazakhs use this platform on a daily basis. It’s a really remarkable market position.

Kevin Murphy (36:57)

That’s bananas. That is a striking number in terms of total penetration. But it also kind of suggests the potential growth wall within that country in terms of just new users to the platform. But as we know, these companies don’t just grow in terms of total new user growth. It’s offering new services and trying to cross-sell within that existing user base. But at some point, they do need to look outside the border.

Brian Crofton (37:21)

That’s exactly right. I think that’s a question we hear a lot from other investors and something that we’ve spent a lot of time trying to figure out. At some point pretty soon you’re going to see that MAU [monthly active user] growth asymptote pretty dramatically. And you’re already beginning to see that a little bit. I mean, you can only grow so many more after when you’re at 75 percent of the population. But I think, therefore, beyond the continued cross-sell and penetration of services into that existing user base, if Kaspi wants to continue to grow its MAUs over time, you’re exactly right. They need to expand overseas. And here they’ve identified three countries in the past that they were looking to expand to.

The first one actually was Ukraine, where they bought a small payments company and were looking to begin building the same ecosystem that they have in Kazakhstan within that country by starting with payments and then layering on use cases over time. That has obviously been put on ice and is no longer a live opportunity for the company.

The other two opportunities that they have as of today are in Azerbaijan and in Uzbekistan, both of which where they operate classifieds business, which is the kind of proto-ecommerce business that they’re looking to develop, right? They have this small pseudo-marketplace that they would begin to develop and then from there start the layer of payments business on top. The opportunity on both of those is probably more in years six to 10 of our investment case as of today, the reason being that as you mentioned, they still have a lot of opportunity in Kazakhstan to drive additional adoption of their existing services, launch new services, again to extract value from the platform they already built.

I think, keep in mind, especially for financial institutions, overseas expansion can be quite difficult because you start running into a lot of regulation, you start running into a lot of local competition.

And then also for a lot of these countries, you need local institutional support, much like how we’ve spoken about Kaspi’s relationship to the power structure in Kazakhstan. It’s not going to be easy to build a successful digital financial institution in some of these other countries without local on-the-ground support as well. And that needs time to be cultivated. And so all of these reasons suggest that over our one- to three-year investment horizon, Uzbekistan and Azerbaijan will not be major contributors. But when you start thinking about 10, 15 years from now, those start appearing to be much more attractive opportunities.

Kevin Murphy (39:40)

Yes, it’s reminiscent of Sea Ltd. and their fintech business, just going country by country, blocking and tackling. And I know a lot of the complaints were: Why is it so slow? Why is it taking so long? But that’s an example of the complexity, even within roughly similar economic situations within Southeast Asia. But one banking license here, one banking license there, and eventually you’ve got a pretty nice fintech business.

Brian Crofton (40:05)

I completely agree. I think a good lesson from all of my work on financial services is that oftentimes slower can be better over the long term.

I’ve taken you down quite the macro and geopolitical rabbit hole.

Kevin Murphy (40:27)

But I’ve got to ask, what did we miss? Any other ideas or thoughts that I didn’t ask about that you consider important to the company?

Brian Crofton (40:34)

You know, maybe the only thing that we haven’t spoken about, and we’ve alluded to it, is the capacity of a platform like this to layer on new services over time. We’ve spoken about these three core services, but I think what is often lost in the investor debate as far as from what I’ve been able to see is the capacity to just come up with new business lines and stack it on top of this platform. And so I’ll give you a couple examples.

The first one is the travel. Kaspi developed its own OTA [online travel agency] system. And within about five years—honestly, within about three years—the business went from having no involvement in this system to being the largest platform in Kazakhstan and having it generate a meaningful amount of GMV [gross merchandise value] for the business. And they did that really 0 to 60 in a short amount of time.

They’re now doing the exact same thing in grocery delivery, so egrocery, a famously difficult business to break even or make a profit. And they’re already making a profit in the capital city where they started, and they’re now beginning to scale that across the country over time as well, leveraging the same couriers that they use for ecommerce, leveraging the same users that they use in payments and in ecommerce and having to plug into that exact same flow of consumer activity.

And then the last one which I think is particularly interesting is they’ve actually started to expand into B2B [business-to-business] payments and so not only are they facilitating transactions between a consumer and the business, they’re now getting involved in business-to-business activity, which opens up receivables financing, access to the insights of these businesses, and, don’t quote me, but you could even start seeing them layer on additional business services over time. You could see them do things like ERP [enterprise resource planning] and CRM [customer relationship management] and these types of services, they really start to generate value in a new direction here.

I think when you have a business platform like what Kaspi has developed in a country that remains underpenetrated across so many services, the potential to start expanding into more and more use cases is really hard to even imagine sitting here today.

Kevin Murphy (42:37)

That’s amazing. Yes. And the advantage there is the locked-in consumer base they already have. So it’s not like starting a new business and trying to find people that will be interested in it. It’s just migrate the user base to those new services. Yes, it’s a powerful, powerful growth model.

Brian Crofton (42:52)

When you have a majority of the population interacting with your business over two times a day, you can do a lot of interesting things.

Kevin Murphy (42:58)

Well, we’ve covered a tremendous amount of ground here, and I know you gave us a great insight into the business itself in addition to the context in which it operates. So it’s fascinating. It’ll be really interesting to see how the country grows and evolves over time.

Really appreciate your time, and I hope to have you back again on the podcast, maybe to talk about this company, but certainly to talk about other companies within what I think is one of the most dynamic but probably misunderstood or maybe you know poorly covered spaces in development. Everybody’s talking about AI [artificial intelligence] and semiconductors and all that stuff. And I think they’re missing this massive wave of innovation and growth in the financial services industry for sure.

Brian Crofton (43:43)

Yes, it’s a very exciting space. It goes under the radar and then it pops up every once in a while, when you have these great businesses really inflect. So looking forward to coming back on to talk about some of those.

As of March 30th, 2024, Tencent, Visa, Nubank, and Sea Limited were held in Sands Capital strategies. No other companies mentioned were held in any Sands Capital strategies at the time of recording and were mentioned for illustrative purposes only.

The views expressed are the opinion of Sands Capital and are not intended as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell any securities. The views expressed are current as the episode date and are subject to change. This material may contain forward-looking statements, which are subject to uncertainties outside of Sands Capital’s control. The securities identified do not represent all of the securities purchased or recommended for advisory clients. There is no assurance that any securities discussed will remain in the portfolio. You should not assume that any investment is or will be profitable. A company’s fundamentals or earnings growth is no guarantee that its share price will increase. For more information, including a full list of portfolio holdings, please visit our website at www.sandscapital.com.