Philosophy & Approach

Philosophy & Approach

At Sands Capital, we maintain a single growth-oriented philosophy that is applied across all strategies.

Our philosophy is rooted in the belief that, over time, stock prices will reflect the earnings power and growth of the underlying businesses.

We practice our philosophy in three simple yet powerful ways

Seek to identify the few truly innovative businesses with sustainable above-average growth

Our core strength lies in applying proprietary, fundamental research to identify leading growth businesses that we think are innovative and offer products and services for which there is no substitute. In our view, the businesses we own tend to be differentiated leaders in their industry with significant competitive advantages. Often, they possess game-changing qualities that allow them to create their own growth drivers through new product development, entering new markets, or innovating within existing markets.

Construct a concentrated, conviction-weighted portfolio

Concentrated investing—allocating more money to what we believe are the right types of wealth-creating businesses—has been a powerful way to magnify the impact of our stock selection over time. Though some investors assert that a concentrated portfolio poses greater risk in terms of higher short-term volatility, we believe that a portfolio diluted with a large number of holdings may introduce the risk of not knowing the businesses well enough.

Maintain a long-term investment horizon

In our experience, attempting to time investment actions typically does not add value to our investment process. As investors in business enterprises—as opposed to stock traders—we focus on trying to understand the strength and duration of the long-term growth drivers for each business. As a result, we are willing to accept short-term stock price volatility in exchange for the potential to create significant wealth over the long term.

Our Six Investment Criteria

1.

Sustainable above-average earnings growth

2.

Leadership position in a promising business space

3.

Significant competitive advantages/unique business franchise

4.

Clear mission and value-added focus

5.

Financial strength

6.

Rational valuation relative to the market and business prospects

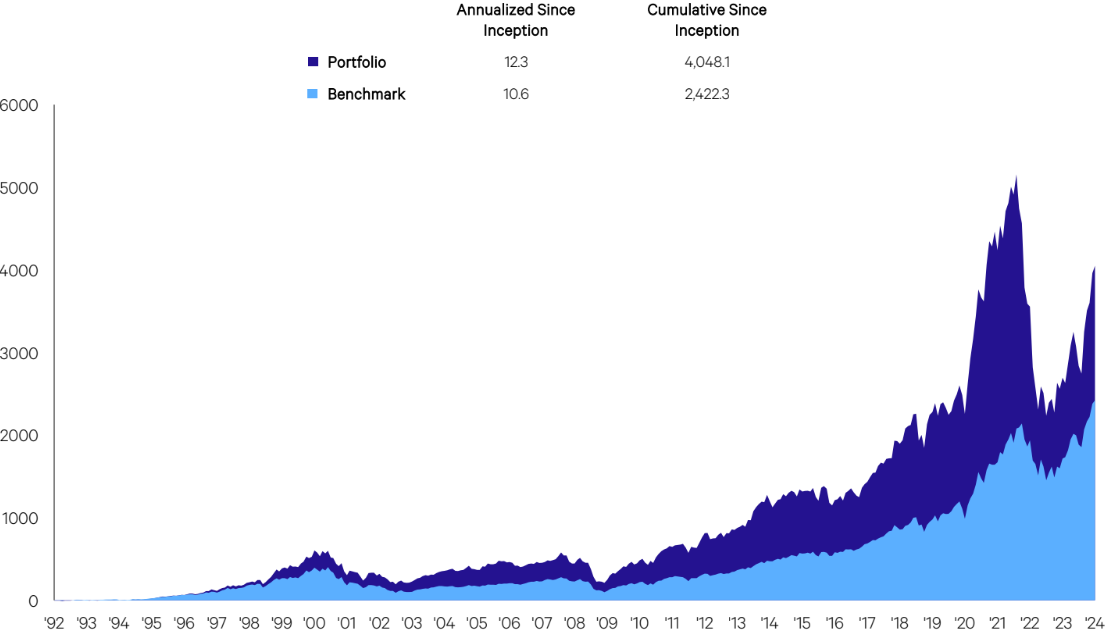

Power of Compounding

We invest for the long term because the key to wealth creation is long-term compounding of value. In our view, there are a few elite businesses around the world that can grow their profit pools sustainably over the long term. We seek to invest in these businesses, be patient, and avoid all other businesses.

Net Results (%) for Period Ending March 31, 2024

1 Inception date is 2/29/1992. The investment results shown are net of advisory fees and expenses and reflect the reinvestment of dividends and any other earnings. The investment results are those of the Select Growth Tax Exempt Institutional Equity Composite. Net returns presented are calculated using actual fees and performance fees if applicable. Past performance is not indicative of future results. GIPS Reports found here. Past performance is not indicative of future results. Source: Sands Capital, FTSE Russell. Net returns presented are calculated using actual fees and performance fees if applicable. The index represented will differ in characteristics, holdings, and sector weightings from that of the Select Growth Tax Exempt Institutional Equity Composite. We expect the strategy to be overweight key growth sectors, including consumer, healthcare, and technology, and underweight highly cyclical sectors such as energy, materials, and financials. All investments are subject to market risk, including the possible loss of principal. The strategy’s growth investing style may become out of favor, which may result in periods of underperformance. The strategy is concentrated in a limited number of holdings. As a result, poor performance by a single large holding of the strategy would adversely affect its performance more than if the strategy were invested in a larger number of companies.

IMPORTANT INFORMATION: The information provided on this website is not intended as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell any securities. All investments are subject to market risk, including the possible loss of principal. Information shown is subject to change. There is no guarantee that Sands Capital will meet its stated goals. Past performance is not indicative of future results. Differences in account size, timing of transactions and market conditions prevailing at the time of investment may lead to different results, and clients may lose money. A company’s fundamentals or earnings growth is no guarantee that its share price will increase. Forward earnings projections are not predictors of stock price or investment performance, and do not represent past performance. You should not assume that any investment is or will be profitable. GIPS® Reports found here.

INDEX: The S&P 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. Broad-based securities indices are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment funds. Investments cannot be made directly in a broad-based securities index.

The Select Growth performance shown is compared to the Russell 1000® Growth Index (R1000G), a broad-based securities market index. The Russell 1000® Growth Index is a subset of the Russell 1000® Index, a capitalization-weighted, price-only index that is composed of 1,000 of the largest capitalized U.S.-domiciled companies and are included in the Russell 3000® Index. The Russell 1000® Growth Index measures the performance of those Russell 1000® Index companies with higher price-to-book ratios and higher forecast growth values. Performance results before January 1, 2002 were measured against the S&P 500 Index. The benchmark was changed to be more representative of the composite strategy, however, information regarding the comparison to the S&P 500 is available upon request. Broad-based securities indices are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment funds. Investments cannot be made directly in a broad-based securities index. Sands Capital Management may invest in securities not covered by the Russell 1000® Growth Index.